6 Bad Money Habits and Tips to Help Break Them

Learn how to break 6 common bad money habits and get on the path to financial success.

Learn how to break 6 common bad money habits and get on the path to financial success.

If you want to enhance your banking experience, make sure you know the differences between traditional and online banks.

Building a sound financial footing for your child requires a mix of education and planning. Here's how to set your child up for success.

Everything you need to know about the new student loan forgiveness plan—and smart ways to use the funds if you qualify.

If you're a parent, teaching about money doesn't have to be hard. Here are tips for how to teach financial responsibility to kids at any age.

These financial literacy games reinforce key concepts with a spirit of fun.

Here are 10 ways to make that extra cash continue to work for you.

Follow these 10 career and money tips now—before you get derailed by a layoff.

The experts weigh in on how to set work and financial goals and—most importantly—how to stick to them.

Here are some of the ways you can financially prepare for some of life's bigger milestones

If finances are affecting your relationship, it might be time to talk to a professional. Here, we break down what financial therapy is and how it can help.

Yes, a first date is a little too soon, but waiting until the honeymoon is not advised. Here, the experts weigh in on when to start having money talks with your partner.

Whether you just started dating or are planning your retirement together, having money conversations throughout your relationship is key.

Want to lower your tax bill? A certified public accountant explains how itemizing these popular deductions on your return could help you save.

Last minute tax steps to take to help get the best refund possible.

Find out what to do during inflation to protect your savings.

What do you do when money worries seem to be everywhere?

Making the most of the holiday season.

Once you finish celebrating, plan the next chapter in your financial life.

When it comes to teaching about money, but share these essential financial literacy lessons with your college kid.

What to do when your dollars are worth less.

Can you retire early and still have a job?

While gig workers face many financial roadblocks, there are new products that can help them on their journey to financial freedom.

Want to improve your financial literacy? Start with this series.

The straightforward (and hidden) deductions in your home.

What could go right and what could go wrong?

What you need to know about this financial tool.

Are businesses better at money? Why?

Five savvy saving strategies.

How to decide if your parents need help—and how to start helping.

Which money skills do you have, and which ones need work?

Tips to relaunch your independent life.

A map of the United States with travel symbols and dollar signs.

The CPI can help you budget smarter.

How to save money like your favorite superheroes save the world.

How to introduce your new partner to your budget.

There are major similarities and differences.

It usually takes saving, investing and planning.

Understanding bank terminology can help you master your money.

Get answers to common money questions, such as how to save money, improve your credit, invest and finance large purchases.

Point yourself in the direction of your dream job.

Starting a conversation can alleviate stress—for everyone.

Learn how one young woman navigated the road to financial freedom—and how you can, too.

All families are different, but all families should talk about money.

Depending on your goals, becoming independent could mean more than retirement.

One mother of three researches the costs of college.

You don’t have to overspend to outfit your new baby.

Taking advantage of low interest rates to get your first mortgage? Here’s everything to keep in mind.

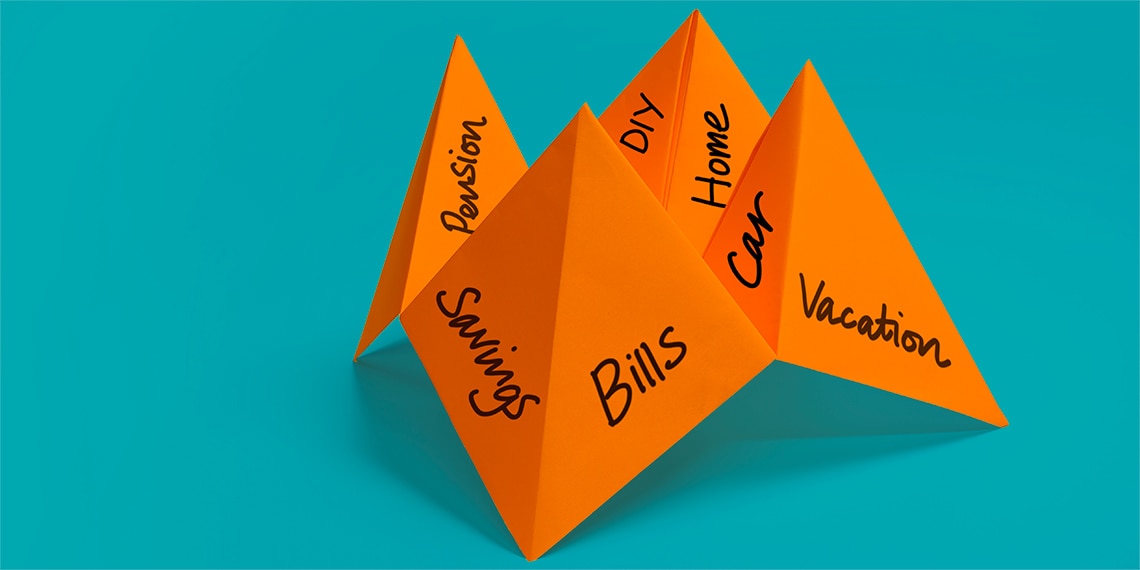

Put together a painless financial plan.

An age-by-age guide to teach saving skills.

Saving money for even the biggest dream starts with a vision and a game plan.

Should you do it too?

Opening a savings account is a great start, but it’s just the beginning.

Everyone should understand the different kinds of financial risk.

How to get organized and set realistic goals together.

Do you act like the rest of your generation with saving and spending? Find out in this quiz.

The story of how this young professional bounced back after unemployment and found her financial footing offers lessons for us all.

Deciding between the career you want and the life you want isn’t always easy. Here’s how one woman figured out her priorities.

Asking your co-workers about their salaries sounds intrusive, but it could help you earn more.

Eileen Cho had a more than comfortable childhood, but without money skills, she floundered financially as an adult.

Here are a few ways to see if you’re developing caviar tastes—and undermining your larger financial goals.

Changes to the way people save for and buy their first homes have created an entirely new set of considerations for first-time buyers.

Save for education expenses in a tax-advantaged account.

This young New York City man knows how to work hard to make his personal finances stronger.

One young woman’s story of using the lessons she learned in childhood as motivation for her future.

Learn the importance of financial freedom, and find the ability to choose how you make money because you are financially secure.

Financial blogger Jamila Souffrant explains how.

A focus on savings and smart investments has paid off for this young couple.

Here’s how a lifelong interest in finance allowed one young author to retire before she turned 30.

Wise advice from voices of experience.

Here’s how savers can use installment loans to responsibly make large purchases while keeping their plans on track.

Credit cards can offer benefits when you’re traveling, reward you for your spending habits or protect you if a purchase isn’t what you expected.

These simple tips can make financial conversations with children a regular part of growing up.

Hint: It will bring you closer—and help you reach your goals sooner.

Why this college student thinks achieving the American dream is harder now than it was for her parents and grandparents.

Here’s how to prep for the price tag and how to talk about it with your partner.

Data storage, wireless capabilities, parental controls and AI? All this is closer than you think.

Don’t wait for an emergency to discuss finances with your aging parents.

What growing up as the child of immigrants and starting a career after the 2008 recession taught this 20-something about money.

Give your child the knowledge and good habits to handle a credit card successfully.

The answer depends on the time you have to devote to managing the cards, how the cards fit into your financial picture, and what you use them for.

Here are 6 strategies for healthier work-life balance.

Now that you can split the tab using your cell phone, be sure you know the social rules.

Here are some questions you should ask before you do.

Stop dreaming of wearing a Rolex or vacationing on your own private island. Sharing is the new acquisition.

There’s more to this generation’s finances than you might expect.

The surprising costs of raising a child in the first 3 years.

Hidden financial transactions between spouses are on the rise. Here’s why that’s a such a dangerous situation for any relationship.

The time to discuss spending and savings is before you pack a single box.

For this financial expert, embracing possibility started with the question, “Why not me?”

This upstart entrepreneur is building vibrant communities—who told him what he needed to get started?

Want to retire early? Really early? Like in your 30s or 40s? Here’s how.

Instead of cutting out all the little things that make your day, consider these smarter ways to cut your budget.

These years can be an incredible shortcut toward building wealth—if couples approach them the right way.

Having a productive discussion will make your new house a happier home.

Two generations of women discuss money and life lessons.

Here’s how to set expectations about who will pay college costs.

This college student had to overcome identity theft when his roommate used his name and credit card online.

Different spending personalities can still work together on finances.

Stabilize both of your finances and build a stronger relationship with your kids.

When do you offer financial help to your adult children—and when do you pump the brakes?

Read how one woman turned her dreams of living in the Big Apple into reality.

Learn when it makes sense to share a bank account with adult children—and when it doesn't.

Here are some factors to weigh when you make this decision with your significant other.

How to start conversations about money with your children, from financial literacy expert Neale Godfrey.

Learn the differences to make informed decisions on which to use.

Do you and your partner pass or fail?

As the ‘gig economy’ changes the way Americans work, the future may hold a more mobile, skilled and (fingers crossed!) happier workforce.

Is your second job improving your life or your bank account balance—or just draining resources?

Here’s how to make a love connection without overspending.

It might be difficult to talk about money as your parents age, but it’s essential. Here's how.

Ask for—and get—a pay increase, by following a few simple steps.

These shifts in how people work are changing the face of the labor market—across all generations.

Don’t let money come between friends—and don’t let friendships wreck your financial goals.

Joining the Gig Economy? Here are tips for planning your schedule.

When your family gives you holiday cash, your first instinct may be to spend it—here’s why that’s not your only option.

How an expectant father saved up to buy the right vehicle for his future family.

Whether you’re a foodie, a beach bum, or an adventure seeker, we’ve got a trip for you that won’t break the bank.

She didn’t have a groom, but she still said “I do” to her dream wedding with a smart savings strategy.

Here’s how to make sure you keep your retirement savings growing after you part ways with an employer.

Marketers of complex financial vehicles are targeting your parents—here’s what you need to know to help them weigh their options.

How online banking, and the rise of smartphones, side hustles, and a new retirement reality have irrevocably altered how we save.

By taking advantage of an automated savings plan, Danielle Desir was able to buy her first home in just two years.

Strategize and create a plan with your parents to avoid derailing your own financial needs.

This is how—with a little determination, hard work and the right tools—one college grad eliminated almost $65,000 in student loans in just five years.

Avoiding a few basic errors can set you up for a secure, strong financial future.

Want your kids to be financially savvy? Start with communication, demonstration and education.

Knowing a few key facts can help you plan ahead.

Just starting out in your career? Use these strategies to put money away to help you unlock future possibilities.

Some early lessons about how credit cards work can help your kids make the most of their first card—and enjoy the opportunities that come with good credit.

Are you looking to save more? Here are some smart options to help you start saving.

When it comes to retirement, employer-sponsored plans are often Plan A—but if your company doesn’t offer one, you still have options.

While our financial lives are each unique, here are a few decade-by-decade priorities and milestones to consider on your journey.

Small changes, especially to bad habits, can make a big difference in your cash flow—and help you find the best ways to save more.

Saving for a rainy day is more complicated—and imperative—than ever before. Here are tips that can help.

The way to reach some of your most ambitious savings goals can be as simple as a few minor changes to your daily money routines.

Retirement seems far away, but the magic of compound interest may persuade you to start planning now.

Have you done your homework on your retirement requirements? Test your knowledge with this quiz.

You said “Yes,” and now you’re on the way to “I do.” Here’s how you can afford your dream wedding.

One key to harmony in any serious relationship is to make sure you’re on the same page when it comes to the important financial decisions.

Here are a few ways to tackle college debt, while building toward bigger financial goals.

The gig economy may be growing, but before you make the leap, it’s a good idea to first do some financial assessments.