While a retirement plan offered through work, such as a 401(k) or 403(b), can be a great way to save for retirement, it’s simply not a reality for almost half of all workers in the United States. And if you’re a gig-worker or a small business owner, you’re on your own when it comes to retirement planning.

The good news is that if you don’t have an employer-sponsored plan, you still have smart options when it comes to saving for retirement, starting with an individual retirement account (IRA). Here are four steps to start planning for retirement if you don’t have a workplace retirement plan.

1

Get started today.

Even if you start with small goals—say $50 or $100 a month—you are making big progress toward an essential long-term goal. And as your earnings increase, consider saving more.

“The best favor you can do for yourself is to start saving as early in your career as possible so you can maximize the power of compound interest,” says Bryan Bibbo, a financial advisor for the JL Smith Group in Avon, Ohio.

2

Make it automatic.

“The beauty of a workplace retirement plan is that contributions are automatically deducted from your paycheck. With an IRA you want to create the same system,” says Elijah Kovar, a founding partner at Great Waters Financial, a Minnesota advisory firm.

You can easily link your checking or savings account to an IRA account and set up automatic transfers into your IRA account, timed to every paycheck. “When you get paid, you want to pay yourself first by sending money into your savings,” says Kovar.

3

Choose the right IRA.

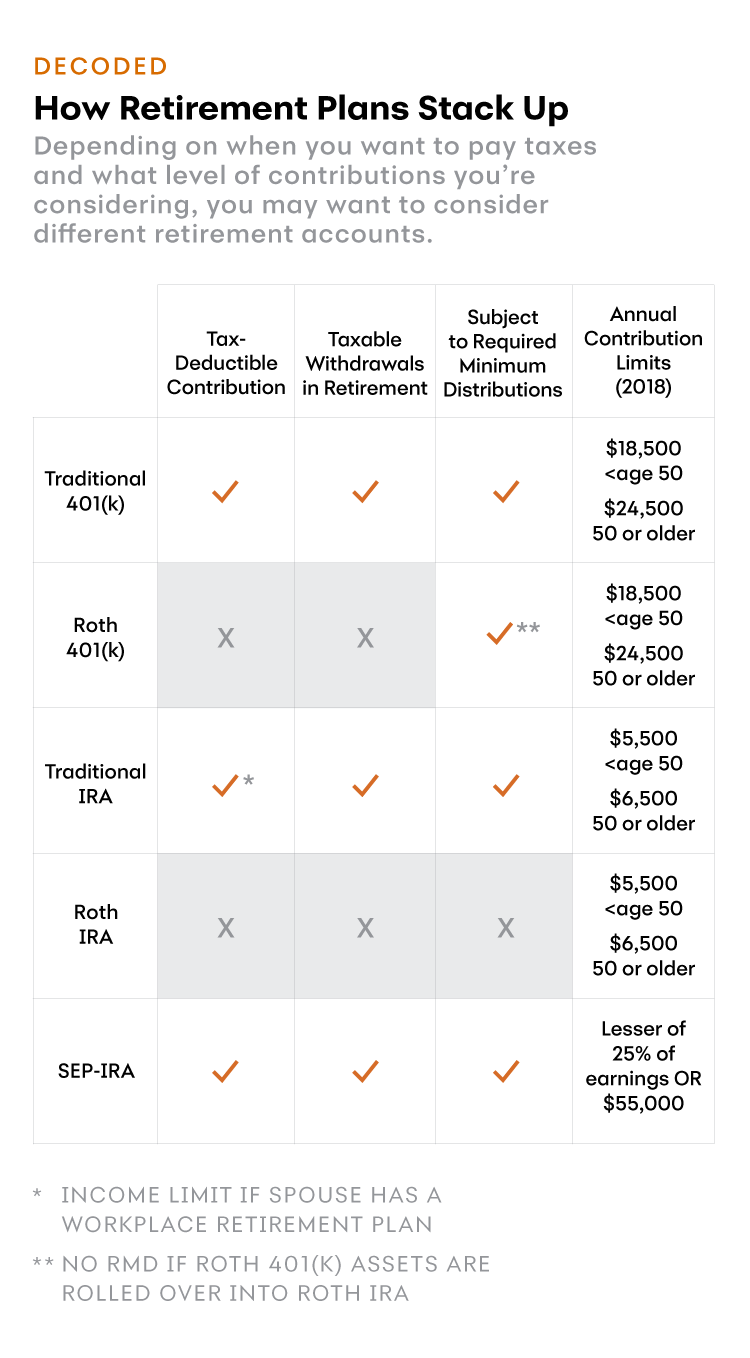

For IRAs, you have the choice of saving in a traditional IRA or a Roth IRA. The main difference between the two options is when you pay taxes. While all IRAs offer tax-free growth while your money is invested, at some point, you will owe tax on your IRA.

● For a traditional IRA, you may be able to deduct your contribution from your taxable income. But in retirement, you will be required to make withdrawals from your IRA, and your entire withdrawal—not just investment gains—will be taxed as ordinary income.

● For a Roth IRA, you pay your taxes upfront, because your contribution comes from after-tax income. The Roth tax break comes in retirement: withdrawals are optional and any money you do withdraw is 100% tax-free.

While the upfront tax break on a traditional IRA helps with this year’s tax bill, in retirement, the prospect of tax-free income can be very valuable. “It’s a question of whether you want to pay tax on the seed or on the harvest,” says Kovar. With a Roth you owe tax on the smaller seed.

4

Max out your contributions.

As of 2018, anyone under the age of 50 can contribute $5,500 per year to an IRA. And if you’re at least 50 years old, the contribution limit is as high as $6,500, so you can “catch up” on retirement savings.

Self-employed workers can open a special type of IRA, called a SEP-IRA, which is short for “simplified employee pension.” The contribution limit to a SEP-IRA in 2018 can be as much as $55,000.

Retirement will likely be your life’s biggest expense—you’ll need to pay for living expenses and healthcare from your own pocket. For the sake of your future, make sure that you start your retirement savings today, even if your company doesn’t have a sponsored plan.

This chart is titled "How Retirement Plans Stack Up" This chart compares retirement accounts according to their tax structures. The chart is in the category called "Decoded" and the title is "How Retirement Plans Stack Up." The description of the chart reads "Depending on when you want to pay taxes and what level of contributions you're considering, you may want to consider different retirement accounts." The chart compares five accounts. They are traditional 401(k), Roth 401(k), traditional IRA, Roth IRA and SEP-IRA. The first column is tax-deductible contributions, which are allowed for traditional 401(k), traditional IRA and SEP-IRA. Tax-deductible contributions are not allowed for Roth 401(k) or Roth IRA. Note that traditional IRAs have an income limit if your spouse has a workplace retirement plan. The second column is taxable withdrawals in retirement, which are allowed which are allowed for traditional 401(k), traditional IRA and SEP-IRA. There are not taxable withdrawals in retirement for Roth 401(k) or Roth IRA. The third column is whether the accounts are subject to minimum distributions. All accounts are except for the Roth IRA. Note that Roth 401(k) assets can avoid required minimum distributions if they are rolled into a Roth IRA. The fourth and last column is the 2018 annual contribution limits for the accounts. For traditional 401(k) and Roth 401(k), the limit for anyone under age 50 is $18,500, and the limit for anyone age 50 or older is $24,500. For traditional IRA and Roth IRA, the limit for anyone under age 50 is $5,500, and the limit for anyone age 50 or older is $6,500. For a SEP-IRA, the annual contribution limit is 25% of earnings or $55,000.

Carla Fried is a freelance journalist specializing in personal finance. Her work appears in the New York Times, Money magazine, Consumer Reports and CNBC.com.