What Are 529 Plans?

● 529 plans—named for the section of the tax code that created them—offer a tax-advantaged way to save for college and certain other education costs.

● There are two types of 529 plans: the 529 college-savings plan and the 529 prepaid tuition plan.

● Beneficiaries are often children or grandchildren, but you can also name a non-family beneficiary.

Paying for future education costs can weigh heavily on parents’ minds. Fortunately, 529 plans can be an easy and effective way to save for education on a tax-advantaged basis. They can even provide a hedge against rising tuition rates.

Understanding 529 Plans

529 plans come in two types: the college-savings plan and the prepaid tuition plan. While both are intended to make higher education more affordable, they take very different approaches. (More on how each plan works below.)

Contributions to both kinds of 529 plan are considered gifts for tax purposes. In 2019, you may contribute up to $15,000 per beneficiary per year to either type of plan without triggering gift tax consequences.

Almost anyone can open an account for any beneficiary, whatever their relationship. And one student can be the beneficiary of multiple 529 accounts. Most 529 plans are state-sponsored, though you often don’t have to be a resident of a state to use its plan.

How 529 College-Savings Plans Work

With a 529 college-savings plan, the account owner contributes money and decides how to invest it. Many plans offer age-based portfolios, similar to that of a target-date fund. The portfolios invest in growth-oriented assets when the beneficiary is very young, then gradually shift toward more conservative investments as college approaches. Investors can also manage the investments themselves, often from a selection of mutual funds, exchange-traded funds, money market funds, high-yield savings accounts, or bank certificates of deposit.

The student can use the funds to pay qualified expenses at college as well as trade and vocational schools. Qualified expenses include tuition, fees, books, supplies, computers and internet access, and even room and board if the student is enrolled at least half-time.

More than 30 states, plus the District of Columbia, provide a tax deduction or credit on contributions to 529 college-savings plans. Generally, you must contribute to your home-state plan to get the tax break, although seven states offer an income tax break no matter what state’s plan you enroll in.

Regardless of where you live—and in which state’s plan you invest—your invested assets grow tax-free, and withdrawals for qualified education expenses are tax-free. Maximum contributions over the life of the account vary by state, and typically range from $200,000 to $500,000.

There’s no age or deadline by which the money in the plan must be spent, and you can change the beneficiary of a 529 college-savings plan at any time. The only restriction is that the replacement beneficiary must be a member of the same family as the original beneficiary—a sibling, first cousin, grandparent, aunt, uncle, or even yourself if you’re part of the family. If you decide to cash out the account instead of switching to a different beneficiary, you’ll pay income taxes and a 10% penalty on earnings upon withdrawal.

Though college-savings plans were conceived as a way to pay for college, the 2018 federal tax reform made it possible for account owners to withdraw up to $10,000 per year to pay for tuition at private schools for kindergarten through 12th grade. Note, however, that not every state has caught up to federal law. In a handful of states, 529 funds used for K-12 tuition will be exempt from federal taxes, but not state taxes.

You can find your state’s plan and compare other states’ plans and features at the College Savings Plans Network.

How 529 Prepaid Tuition Plans Work

529 prepaid tuition plans take a different approach, allowing account owners to pay for future college tuition costs today.

• Compared with college-savings plans, there are far fewer state-sponsored prepaid tuition plans, and they impose more restrictions on what costs are covered. Most of these plans have residency requirements for the account owner, the beneficiary or the beneficiary’s parent.

• In addition, there is one private prepaid tuition plan, which includes nearly 300 private colleges and universities.

As with 529 college-savings plan, contributions to prepaid plans are deductible in some states.

Depending on the plan you choose, there are three ways to structure the prepayment:

● Prepaying a certain number of semesters of tuition at a specific state’s public colleges.

● Purchasing fractional shares of a year’s tuition at a specific state’s public colleges.

● Purchasing certificates worth a set amount of tuition at participating private colleges.

As of September 2019, only Florida, Maryland, Massachusetts, Mississippi, and Washington offer guaranteed prepaid tuition plans that are open to new enrollment. With a guaranteed plan, the prepaid credits effectively increase in value at the same rate as participating schools’ costs. Michigan and Nevada offer prepaid tuition plans, but they are not guaranteed by the state and may lose value.

These plans also can be used for tuition at other schools, but the payout is based on the current average tuition rate at the prepaid plan’s schools. In other words, if you paid for three semesters of tuition at a participating school, you would generally receive the cash equivalent of that tuition for a beneficiary who decides to enroll elsewhere.

You can change the beneficiary of a prepaid tuition plan to a family member of the original beneficiary, though the new beneficiary must also meet the plan’s residency requirements. Maximum contribution limits are set by each state’s plan and are often equivalent to eight semesters of tuition.

Who Should Open a 529 Plan?

College-savings plans have broad appeal. You can invest in most out-of-state plans and distributions can be spent on a wide range of educational expenses. Given the 529 college-savings plan’s tax advantages and range of options, almost anyone with an appropriate beneficiary would benefit from opening one.

For people who are averse to the risks inherent in investing, a prepaid tuition plan guaranteed by the state will generally offer a better return than other low-risk savings options. But the dwindling number of such plans, and their typical residency restrictions, may make prepaid tuitions plans impractical for many families.

Maryland Family Sees Multiple Benefits in 529 Savings Plan

When Margaret Gebauer’s stepson Beckett was 12 years old, she and her husband decided to set up a 529 college-savings plan to help fund Beckett’s future college education. Attracted by the account’s potential earnings growth, the couple chose a plan sponsored by their home state of Maryland.

Now, Gebauer’s stepson is a junior in high school, and her only regret is not having opened a 529 college-savings account sooner, she says. She’s been particularly happy with the annual returns of this account and the state income tax break she gets by contributing to the plan. Maryland allows each account holder to deduct up to $2,500 in annual contributions. Because Gebauer and her husband each opened a separate account for Beckett, they can deduct a combined $5,000 annually.

The account even came with an additional bonus: The structure of the 529 plan makes it appealing for other family members to contribute, knowing it’s formally earmarked for education. “My mom gave us a chunk of money to put in,” Gebauer says. “And it was nice to be able to put it into an investment account that is actually growing with the market.”

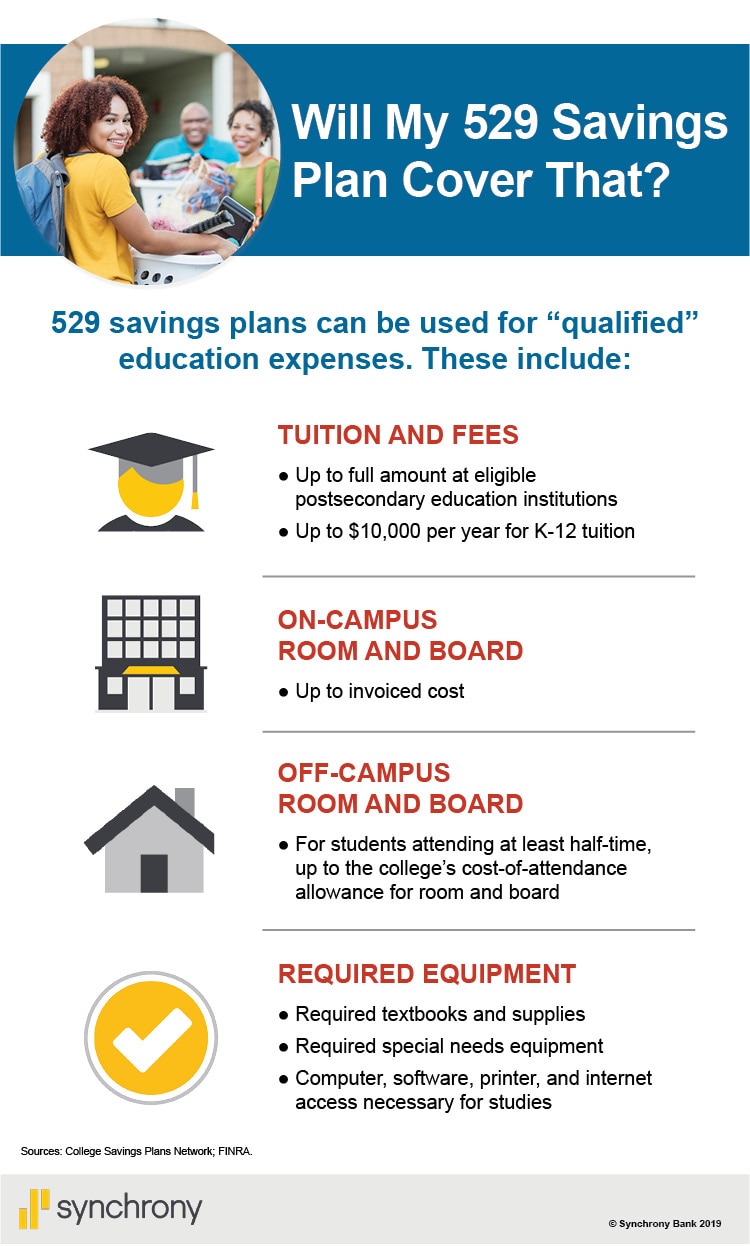

This chart is called Will My 529 Savings Plan Cover That and lists qualified education expenses such as Tuition and fees, On-campus room and board, Off-campus room and board and equipment required for enrollment or attendance. Its sources are College Savings Plans Network; FINRA.

Param Anand Singh writes about money, investing, art, and culture from his home in Henderson, New York.

To save for a big expense in an FDIC-insured account, consider a high yield savings account.