For many people, their thirties are some of the best years of their lives. It’s a time when a person often begins to make a good salary and starts a family. Retirement seems so far away that it’s easy to put any thought of it on the back burner. But you should resist that temptation. A little sacrifice now can make a huge difference down the road.

“It comes down to whether you want to eat stale bread or croissants for retirement,” says Chris White, certified financial advisor and author of Working with the Emotional Investor.

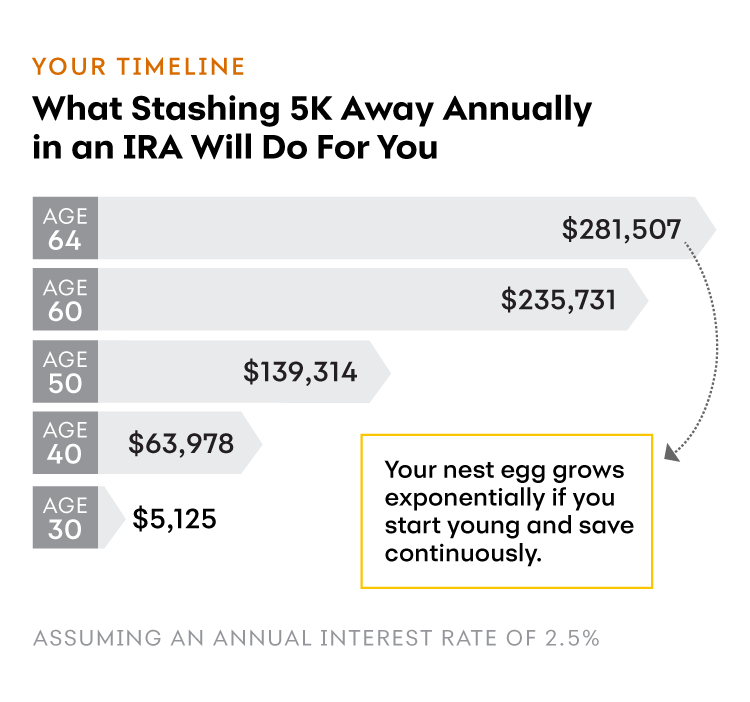

There’s one major reason to start building your retirement savings in your thirties: compound interest. With compound interest in a high yield savings account, for example, you’re not only earning interest on the money you deposit, but over the years you’ll be earning on the interest that accumulates, making your savings grow even faster. And that means that the earlier you start putting money aside, the more it can grow.

A certificate of deposit, or CD, can also help you save with compound interest. Say, for example, you invest $2,000 in a CD with a 2.05% interest rate that compounds annually. After one year, that $2,000 will have earned $41 in interest. At the end of the second year, the $2,000 deposit will have earned $83 in interest. And by the end of three years, your $2,000 initial investment is worth $2,126.

And if you’re saving for retirement, you’ll find that the same compounding, plus tax advantages, in savings programs like Individual Retirement Accounts (IRAs) offer better returns, depending on the product you choose. Freelancing? You may want to consider a self-employed IRA account.

By saving for retirement with an IRA CD or money market account, you get peace of mind because you’re insured by the FDIC, meaning that the government protects your deposit, up to $250,000. These retirement savings accounts can be important components of your planning.

At the same time, you should see if your employer offers a 401(k) plan, which allows you to make a retirement investment using your pretax earnings. Many companies also offer matching plans for employees who contribute to a 401(k), meaning that many employers provide matching contributions to your 401(k) account, sometimes up to 100% of your contributions.

If your 20s are the decade when you go wild, your 30s are when you start to grow up. And part of that process is realizing that it’s time to start thinking about what your life could be like after your working days are over and the kids are grown.

“One of the challenges for people in their thirties is they tend to still have the adolescent sense of immunity from life’s realities,” says White. “They don’t see that there’s a limited opportunity to sock away money for when they’re 65 or 70. But they need to.”

For many people, their thirties are some of the best years of their lives. It’s a time when a person often begins to make a good salary and starts a family. Retirement seems so far away that it’s easy to put any thought of it on the back burner. But you should resist that temptation. A little sacrifice now can make a huge difference down the road.

Chris Morris regularly contributes to national outlets, including Fortune, CNBC.com, Voice of America, Variety and Common Sense Media, as well as dozens of other major publications.

Illustration by Jack Hudson.

Learn how IRAs can make saving for retirement easier in this short video.