When you leave a job, you have a lot on your mind. It’s easy to forget about the things that don’t feel urgent—like dealing with the 401(k) account you’ve been faithfully contributing to for years. But when it comes to your retirement plans, that can be a costly mistake.

Americans hold an average of 12 jobs by the time they’re 50, which means that many of us collect old 401(k) accounts as we move from employer to employer—often because we aren’t quite sure what to do with them.

That’s why it’s so important to know your options for your 401(k) when you leave a job. Simply put, you can cash it out, leave it where it is, or roll it over to a new retirement account.

Option 1: Cash it out

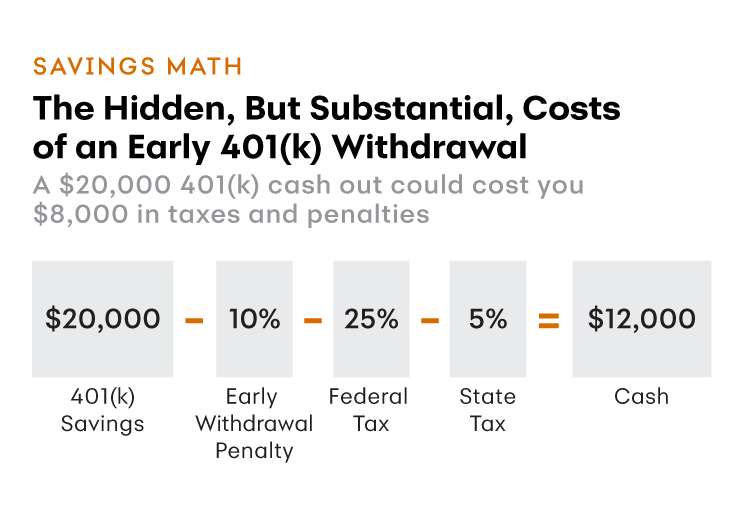

Let’s start with cashing out your 401(k)—a tempting option, but one you should avoid. When you withdraw funds from a 401(k) account before retirement, you take a double financial hit.

First, you’re undoing all the work you’ve done to save for retirement—and you can’t get those years back. And the real cost isn’t limited to the savings you’ve amassed so far, but also the years of returns that those savings would compound if you kept them invested.

Secondly, you’ll have to pay federal and state income tax on money you withdraw. And, if you’re younger than 59 1/2, you’re likely to face an extra 10 percent early withdrawal Federal tax penalty. Talk to your tax professional before you decide to take early distributions.

Option 2: Leave it where it is

You can also leave your 401(k) account with your former employer. This is the path of least resistance, but might not be the best idea. You’ll need to keep track of any fees associated with your account, and your investment options are limited to the plan’s investment offerings. Some plans also restrict ex-employees’ benefits, such as access to new investments or reallocation.

There’s also the paperwork: For every account you have, you need to track and manage each one individually.

Another important reason not to leave the decision on the backburner too long: If your account balance is less than $5,000, your old employer may not allow you to leave the money with in its retirement plan. That means you may be cashed out if you don’t act.

Option 3: Roll it over to a new retirement account

If you’re serious about saving for retirement, then the best option is often to roll over your old plan into a new retirement account. It preserves your retirement savings and gives you flexibility.

If you’re starting with a new employer, check to see if their plan offers a diverse menu of investment options with low fees, to help you determine if you want to roll your old 401(k) into your new account.

Another smart option is to roll your funds into an individual retirement account (IRA). Unlike a workplace-sponsored 401(k), your IRA savings aren’t tied to your job. IRAs offer a wide variety of investment options, with low fees. To avoid paying any taxes now, roll your funds into a traditional IRA, which allows you to contribute pretax dollars.

As with a 401(k), money in an IRA grows tax-deferred, which means you pay taxes only when you withdraw, with similar penalties for early withdrawal.

How do I start a rollover?

The process has gotten more streamlined in recent years. Many times, you can initiate a direct rollover, which means you fill out a form with both the custodian of your old 401(k) account and your new IRA provider, and the funds move straight from the old account to the new one.

The whole process may take a couple of hours and require a few phone calls. It can seem like a headache when you’re in the middle of a busy time. But it’s a small price to help keep you in control of your path to retirement.

Taking advantage of a rollover is a good way to avoid taxes, manage multiple accounts, and keep them growing—all the way to retirement.

This chart is titled "The hidden but substantial costs of an early 401(k) withdrawal" A $20,000 401(k) cash out could cost you $8,000 in taxes and penalties. There is a 10% early withdrawal penalty, 25% federal tax on the withdrawal, and 5% state tax. In this example, the recipient is left with $12,000 on their $20,000 savings.

A former Wall Street Journal reporter and Inc. magazine editor, Simona has reported and written on an array of business and financial topics including investing, leveraged finance, business strategy and business planning.

- https://www.irs.gov/retirement-plans/plan-participant-employee/401k-resource-guide-plan-participants-general-distribution-rules

- https://www.bls.gov/news.release/pdf/nlsoy.pdf

- https://www.cnbc.com/2017/11/30/heres-how-to-roll-over-your-401k.html

- http://www.narpp.org/fiacademy/what-happens-if-i-get-fired-or-laid-off#divID3

- https://money.usnews.com/money/retirement/articles/2009/01/12/5-ways-to-protect-your-401k-if-youre-laid-off