As people save for their financial goals, many choose to put some of their money into the stock market, in hopes that their money will grow and multiply over time. While some people invest in the market, others trade.

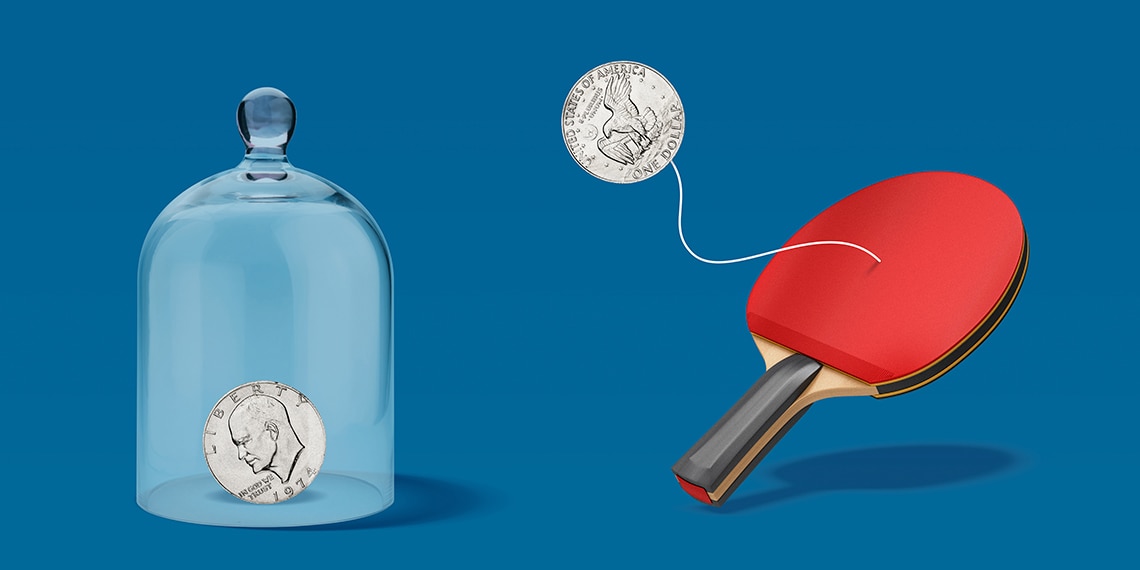

So, what’s the difference between investing and trading? The relationship between them is sometimes misunderstood. Both involve the stock market, and both involve the buying and selling of stocks.

But the ways that people trade (especially day-trade) stocks are very different from how they invest. The difference comes down to a few things. One is the way that they buy and sell stocks. Another is the amount of time and effort they’re willing to put into researching and monitoring their investments. And probably the most important difference has to do with the time horizon of the financial goals they hope to reach by buying and selling stocks.

Are Trading and Investing the Same?

On a basic level, trading and investing are the same. In each, a person buys and sells stocks. They may do so by purchasing the stocks directly, or through a mutual fund that invests in stocks and bonds, or through an exchange-traded fund (ETF) or other vehicle. To trade or invest, a person needs to open a brokerage account, or an account with a money manager, such as a mutual-fund company. (These days, you can become an investor by opening a brokerage account directly on your smartphone with apps.)

Whether you are practicing trading or investing can depend on your goals. While traders often have goals related to making a certain return on a given stock, investors often think about personal financial goals that can await them five, 10 or 50 years in the future. Investors will buy stocks and then hold on to those stocks for long periods—sometimes decades. Traders, meanwhile, might try to buy and sell a stock in a month, a week, a day or even an hour—whatever it takes to meet their return.

In addition to holding stocks for a longer period, investors also strive to reduce the market risks they face. By purchasing a wide variety of stocks, investors can diversify their holdings and reduce the risks they face should a given company or sector of the economy perform poorly, or even lose money. By holding those stocks for longer periods of time, they reduce the risk of investing at the wrong time and losing money simply because the broader market is going through a short-term downturn.

What Is Trading?

Trading refers to the practice of buying and selling stocks. Every investor must trade. But trading, as distinct from investing, refers to the short-term buying and selling of stocks for quick profits. The time horizon for most trading strategies can be as long as a few months, but also as short as a few minutes.

While an investor may research a stock’s underlying company and the broader economy to determine the company’s growth prospects in the coming years, a trader is more likely to look at what the market is doing, and at recent shifts in the stock’s price, to anticipate any price fluctuations in the next day, week or month.

Traders are also more likely than investors to make use of sophisticated financial derivatives such as options, which allow them to benefit from a stock’s price gains or losses without ever directly owning the stock. For example, the use of call options to benefit from short-term declines in a stock’s value, known as short selling, is a popular tactic of traders. (Remember that these types of trading strategies may come with risks.)

There are professional traders who work for asset managers such as mutual funds, hedge funds and pension funds. Individual traders who buy and sell for their own account very rapidly, often buying and selling the same stock within hours, are called day traders. But both tend to buy and sell on similarly short time frames, and to employ similar tactics.

When Should I Trade?

The appeal of trading is that traders have been known to make a great deal of money very quickly. But they can also lose money just as quickly.

Even if investing for short periods, traders need to do rigorous research on how the market works and the factors that drive the price increase or decline of a given stock. It involves following industry trends and company news, like earnings releases, which can drive a stock’s rise or fall. As such, making money as a trader can quickly evolve from a hobby to an obsession, and possibly to a full-time job.

Also, in order to trade, an investor needs money. That often means risking a portion of one’s own hard-earned savings. That’s why most experts recommend that beginning traders start by trading an amount of money that’s not essential to the trader’s near-term financial plans.

For people with time to research, money to invest and an interest in the markets, trading may be the way to go.

What Is Investing?

Investing does look like trading. It involves purchasing assets like stocks, bonds, real estate, cryptocurrencies and so on, with a plan to eventually sell them at a profit.

But the differences beneath the surface are profound. One major difference is the amount of research required. Especially for an investor going into the stock market, there are many highly diversified mutual funds and ETFs to choose from. There are also “life cycle” mutual funds that are designed to move into less-risky investments over time, in step with an investor’s own personal plans to eventually sell out of their investments. Those set-it-and-forget-it options can make investing easy and relatively simple for new investors without the time to devote to market analysis.

Ultimately, investing is about longer-term goals and plans. Famous investors spend a lot of time investigating the way a given company is likely to perform in the years and even decades to come before they invest in its stock. Investing legend Warren Buffett once said, “Our favorite holding period is forever.”

When Should I Invest?

Because of the long-term nature of investing, most experts will say the best time to invest is essentially as soon as possible. That’s because the gains in an investment portfolio—similar to those in a savings account—compound over time. Whether an investor wants to buy a home in five years, pay for a child’s education in 10 or retire in 40, having money in the market for more time has historically resulted in bigger returns.

The good news for many would-be investors is that they may already be invested in the markets through an employer-sponsored retirement plan, like a 401(k), which can also reduce the income tax they owe at the end of the year. There are other tax-advantaged ways to invest in the market, such as an IRA for retirement and even 529 plans for education expenses.

But if it’s all too confusing, there are also financial advisors to help you find the best investments, and best investment vehicles, for your plan. Some will charge a fee, so be sure to discuss that upfront. But they can be invaluable in setting an investor up for long-term success.

Can I Day-Trade and Invest?

Both investing and trading have their advantages. And if both appeal to you, then the good news is that you can do both.

It’s not uncommon for investors to keep some money in retirement accounts and mutual funds for the long term, while actively trading individual stocks in a separate account. Some common rules of thumb for this practice include keeping the accounts for trading and investing separate, regularly rebalancing to make sure that the overall portfolio of stocks doesn’t exceed a predetermined risk threshold, and never risking more money by trading than a particular financial plan will accommodate losing.

Becoming a better trader may even make you a better investor. The key things to remember—whether through a one-day holding period or a 40-year one—are your reasons for being in the market and how to maintain a balance.

Colin Dodds has written for preeminent media and financial companies. He is the author of several acclaimed books, including Ms. Never and Watershed. He lives in New York City with his wife and children.

Learn more about investing and check out “Investing Terms Everyone Should Know”