Congratulations—you’re moving on up! Maybe you got a promotion or a hefty bonus. Or perhaps you’ve paid off some debt.

Now you can save for the things that truly matter. In the meantime, you have a license to treat yourself, right? Sure, but be aware that before long, your spending can catch up with or even surpass your new, bigger budget.

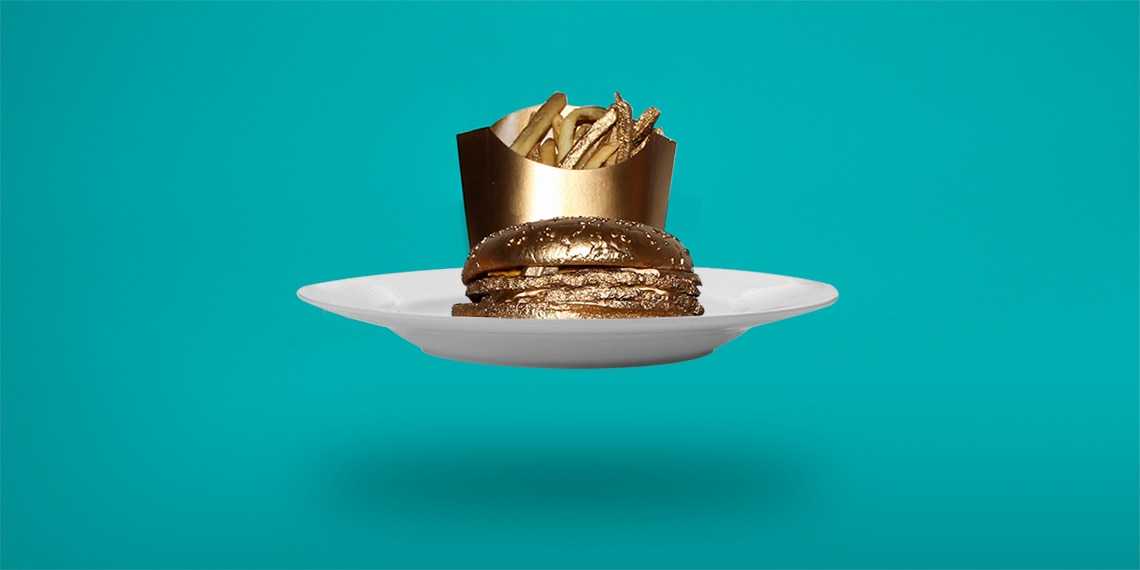

This phenomenon is so common that experts have a name for it: lifestyle creep. “It’s the temptation to start spending more on luxuries as your disposable income increases,” says Shannon McLay, a financial advisor and founder of The Financial Gym. “Before you start spending extra funds, it’s important to outline your budget and long-term goals to ensure you stay on track for the future. For instance, this might be a great opportunity to start investing more for retirement, or to purchase the home of your dreams.”

Before you opt for a pricier car, upgrade your airline seat or splurge on that designer watch, consider what constitutes a “need” versus a “want,” McLay suggests. “By continuing to spend within the means of your previous income, you’ll maintain the ability to save and invest more money each month,” she says. “If you live below your means, you can put that ‘saved’ money toward a goal, like travel or a different savings bucket.”

Here are some ways to tell if you’re suffering from lifestyle creep—and how to outsmart it.

1

Your Social Life

● The signs: You’re going out more often, spending more money when you go out, or picking nicer places. “That starts to add up,” warns Anthony J. LaBrake, CFP at Adam Financial Associates.

● Reverse it: Make a plan to go out one or two nights a week—and stick to it. “If you allot 30% of your income to discretionary spending, be sure to stay within that guideline, even if you’re making more money. It’s easier to start a new habit than to break one,” he says.

2

Your Wardrobe

● The signs: You may have been a die-hard sales shopper in the past, but now you find that you’re buying more clothes at full price. Maybe you’re receiving online orders almost daily. Or perhaps you finally purchased that designer handbag, shoes or watch you’ve been eyeing for years. “Once people have more money, they feel like they can spend more,” says LaBrake. “They want to show it off with a status item.”

● Reverse it: It’s okay to shop, as long as you’re intentional about it. LaBrake suggests that when you get a raise or a bonus, sock away at least half of it. And if you really want a shiny new toy, go ahead and get it—as long as you’ve saved up for the purchase and have it slotted into your budget.

3

Your Commute

● The signs: Maybe you decide to trade in your car for a luxury model. Or, if you live in a city, you start taking car services more often instead of public transportation. “This is a common one, even for people who are typically smart with money,” says LaBrake.

● Reverse it: Think twice about taking on a hefty car payment, which often comes with more expensive maintenance costs. “If you’re looking at a $600 or $700 payment per month, ask yourself, ‘Why do I need that?’ If it’s a real priority of yours, then cut back in other parts of your life in order to stick to your budget,” says LaBrake.

4

Travel and Vacation

● The signs: Maybe you’re opting for luxe hotels and booking spa treatments for the first time. Or perhaps you’re taking far-flung international trips instead of domestic vacations. Even if you’re not splurging for a business-class ticket, you might be paying $40 extra on every flight for priority boarding or extra legroom.

● Reverse it: Resist the urge to hop on a plane to Bali, even if all your friends are posting photos from there. “Just because you can, it doesn’t mean you need to,” says LaBrake. In order to keep your spending in check, do your homework and plan well in advance to get the best deals. Set aside money every month for your dream getaway, and consider vacationing during “shoulder season,” when prices are lower and crowds smaller.

5

Household Comforts

● The signs: Is your home the perfect temperature 24/7? Are your groceries all organic and name brand? Are you getting things delivered that you normally would have picked up yourself? “When it comes to lifestyle creep, people notice the big things, like cars and vacations, but not the small things,” says LaBrake.

● Reverse it: To keep yourself grounded, try doing one thrifty thing a month: buy something used instead of new; borrow a book from your library; make do with what you have rather than purchasing a specialty gadget; or cook dinner with what’s already in your fridge instead of buying more groceries.

6

Entertainment

● The signs: Maybe you’re spending more on hobbies, like a record collection or sports equipment. Perhaps you’re splurging on nicer seats at a concert or a play.

● Reverse it: Every quarter or so, take a hard look at your spending. Keep an eye out for things you no longer use—like a gym membership or a free trial you forgot to cancel—and get rid of them. Then, add the amount they cost to your monthly savings.

This may seem like a lot to keep track of. But by monitoring the areas where you spend money, you can keep lifestyle creep under control—and make sure that the good news you’ve received remains good news in the years ahead.

Maridel Reyes is a journalist based in New York. Her work has appeared in Forbes, Bloomberg Businessweek, the New York Post, USA Today and The Boston Globe.

Read next: Personal finance expert Laura Adams reveals the one money move that makes saving easier.