Building your nest egg on an entry-level salary might seem daunting, or even completely out of reach. Rent, the occasional dinner out, student loans and other bills and debts can quickly drain your bank account when you’re just starting out.

But saving, even early in your career, is vital to your long-term financial health. The reason? The earlier you begin stashing away money, the more time it has to grow. Even modest amounts in a high yield savings account can grow over time.

Try these strategies to help you put more money in the bank with every paycheck.

1

Find out where your money is going

To determine how much money you can realistically save, get a handle on exactly how much you’re spending each month and what you’re spending it on. Try using a free budget tracking app for a month to analyze your cash flow—you may just be surprised. “I was spending so much on eating out, whether it was a morning coffee, drinks with friends, or ordering take out,” says Daniella Bizzell, a twenty-something marketing and communications specialist from Portland, OR. Using a spending tracking app helped Bizzell prioritize her spending, instead of just wondering where the money went.

Bizzell found that using the color-coded graphs in the app, denoting each category of spending, helping her visualize budget downfalls effectively—and find ways to spend less. “Even making coffee just a week out of each month saves close to $40,” she says.

2

Set a realistic budget

Once you’ve analyzed your cash flow, draft a budget that accounts for all of your monthly bills, with spending limits for fluctuating expenses like groceries and entertainment. Once you’ve done this, you should set up automated bill pay wherever possible to eliminate the possibility of late fees. “Every single one of my bills is automatically deducted from my checking account,” says Bizzell. “It helps me stress less about making payments on time, while simultaneously budgeting, so I can stash some money away elsewhere.”

3

Look for savings opportunities everywhere

Even small conveniences—think coffee runs and parking fees—can add up to a lot of dough over time. Ask yourself if you can do without any of these small, but regular expenditures. “I go grocery shopping more consistently, knowing full well I'll get way more of my money's worth if I make lunch as opposed to buying it,” says Bizzell. “I paint my nails at home because I do, in fact, own nail polish. And more than anything, I've practiced self-control and the art of patience.”

Another effective savings move is to compare utility payments, including phone plans, internet providers and insurance companies, to see whether switching providers might lower your monthly bills.

4

Plan your spending around your savings, not the other way around

It’s easy to make the mistake of trying to save whatever’s left over after you pay your monthly bills. The problem is that you may not find yourself with much left to save. Treat your savings contribution as a line item in your monthly budget instead. “After every paycheck, I pay off credit cards, and transfer money to savings and an investment account,” says Sam Seekins, a director at an insurance company in Portland, ME. “Keeping my checking account balance low helps me stick to a tighter budget, because it never feels like I have money to spend.”

5

Streamline your savings process

To make sure you’re following through on your savings plan, opt for a simple automated solution through your bank. Decide how much you want to save from each paycheck and have that amount automatically routed into a savings account. “My budget spreadsheet tells me how much I should be able to save from each paycheck,” says Seekins. “I set that as my automated savings threshold. It forces me to actually stick to my budget!”

6

Save your tax refund

When a tax refund or cash gift comes your way, it can be tempting to spend it right away. But these small windfalls can serve a greater purpose. Use your tax refund and any monetary gifts you receive to build an emergency fund, make a retirement savings contribution or to work toward another savings goal. “For the past few years, I’ve used my tax return and bonus to help max out my Roth IRA contribution for the year,” says Seekins. “I like to knock that out early so I don’t have to worry about it for the rest of the year!”

7

Use different accounts for different goals

Explore your options when it comes to various types of savings accounts. You may find a high yield savings account is perfect for your emergency fund, while it makes more sense to keep your retirement savings in a tax-advantaged IRA. For slightly longer-term goals, you may want to consider certificates of deposit (CDs), which can offer higher yields.

8

Get in the habit of saving now, and keep it up when your salary increases

When you receive a raise, it’s natural to want to relax your budget and increase your spending. But your money will go further if you resist that urge, and instead increase your savings contributions (perhaps after splurging on a celebratory night out!). You’ve already learned to live on a modest income, so maintain your careful spending habits as you progress in your career, and you’ll reach your goals faster.

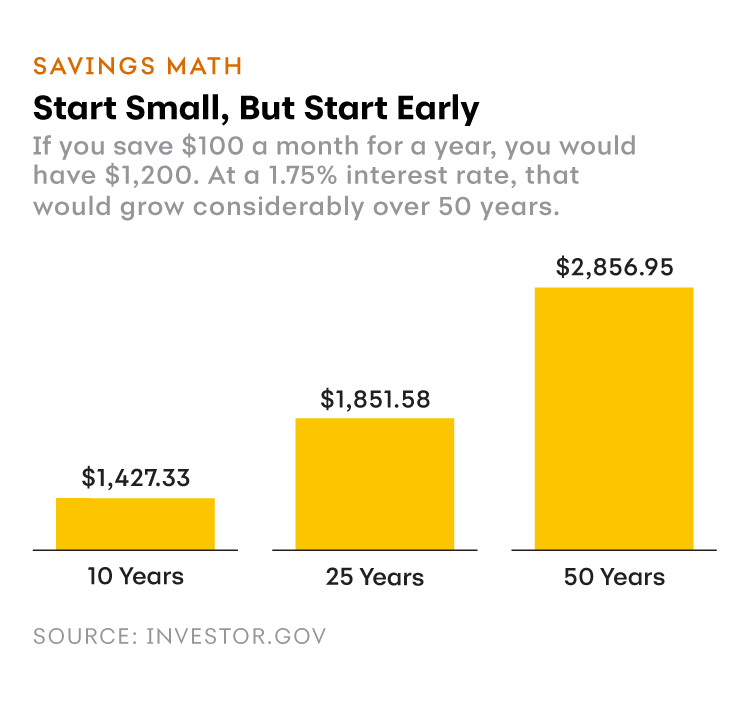

This chart falls into the "Savings Math" category. The title is "Start Small, But Start Early." The introductory text reads, "If you save $100 a month for a year, you would have $1,200. At a 1.75% interest rate, that would grow considerably over 50 years." The chart has three bars to show the growth: 10 Years is $1,427.33. 25 Years is $1,851.58. 50 Years is $2,856.95.

Emily E. Smith is a freelance writer in Bozeman, MT. She writes for national and regional publications on topics ranging from personal finance to crime to wild animals. Her work has appeared in the The Guardian, Smithsonian Magazine and Atlas Obscura.