When Sarah Wunder found out she was pregnant, she had to prepare for a dizzying array of new needs and experiences. And that wasn’t limited to just shopping for onesies and bottles. Staring down the prospect of an unpaid maternity leave, the Chicago resident began to strategize about how to manage her finances during the time she would need to take off.

She started by diverting one-third of each paycheck into a savings account, so that by the time she had the baby, she had saved up nearly enough to cover her expenses for a 12-week leave. Siphoning that money into a separate account meant she had to cut back on other financial priorities, like paying down debts. But in the end, it paid off in more ways than one, she noted. “It was good practice for day-care payments,” which can top $1,000 per month in many parts of the country.

Even with her prudent planning and saving, Wunder recalls that there were still financial roadblocks. She had to prepay health insurance premiums for both herself and her baby—before the baby was born—since she wouldn’t be receiving a paycheck with automatic healthcare deductions. Then, once the baby was born and she was no longer working, her bank charged her a monthly fee on her checking account, because her direct deposits lapsed. It wasn’t much, Wunder says, but it was one more financial frustration during a time when she wanted to focus on taking care of her newborn.

For Women, Knowledge Is Power

Wunder is not alone in her situation. More often than not, the burden of planning and caring for the family falls to women. On average, women spend 12 years out of the workforce raising children or caring for elderly relatives or friends, according to the National Center on Caregiving. And just 12% of Americans have paid family leave through their jobs, which makes time off financially stressful—stress that comes on top of the daily rigors of caretaking.

It can be difficult to anticipate everything that will arise while you’re taking an unpaid leave. But there are steps that you can take to be as ready as possible.

- Know your benefits. If the company you work for has 50 or more employees, the Family and Medical Leave Act guarantees you 12 unpaid weeks off. Certain states, though, offer additional benefits—and your employer likely has its own rules. Many companies, for instance, allow workers to apply unused sick or vacation days toward their leave period, in effect giving you a few days or weeks of paid time off. Talk to your HR department to see what applies to you.

- Start saving early. The sooner you start diverting your income to savings—like Wunder did—the better off you’ll be. If you’re thinking of trying to get pregnant, or if you have an aging parent who may soon need some extra help, consider setting aside some funds now. If you don’t already have an emergency fund, start there. You’ll want enough to cover unexpected emergencies for several months. If you already have that covered, then start building a maternity fund. Start early and consider using high yield savings accounts, which will help your money grow. This will help cover expenses for the months you’re planning to be out of the office. The total you’ll want to spend will depend on your expected expenses, as well as the income you may have coming in from a working spouse.

- Rethink your budget. While you can, try to rein in dinners out and other extra spending. Take a closer look at where your discretionary spending goes: Is it trips to the mall, new gadgets or weekend outings? By trimming a little from each spending category, you can make a big difference in your savings.

- Don’t neglect retirement savings. It may be tempting to fill your maternity or family leave fund by pressing pause on your retirement savings. But resist that urge. Making $6,000 in retirement contributions while you’re preparing for and on maternity leave could turn into more than $30,000 after compounding for 30 years. With longer life expectancies, women need to maximize every retirement saving opportunity.

- Work a little extra now. If you’re stressed about saving enough in time for your leave, see if you can pick up a few extra shifts or ramp up your side gig temporarily. See if your spouse or partner can do the same. Chances are you’ll both be too tired to take on extra work with an infant in the house, so consider redoubling your efforts now if you can.

Time off to care for family is something that many people wouldn’t trade for all the money in the world, but that doesn’t mean it has to completely derail your finances. By starting to plan as early as you can and taking a few careful steps, you can spend your family leave focused on the ones you love—not your bank account.

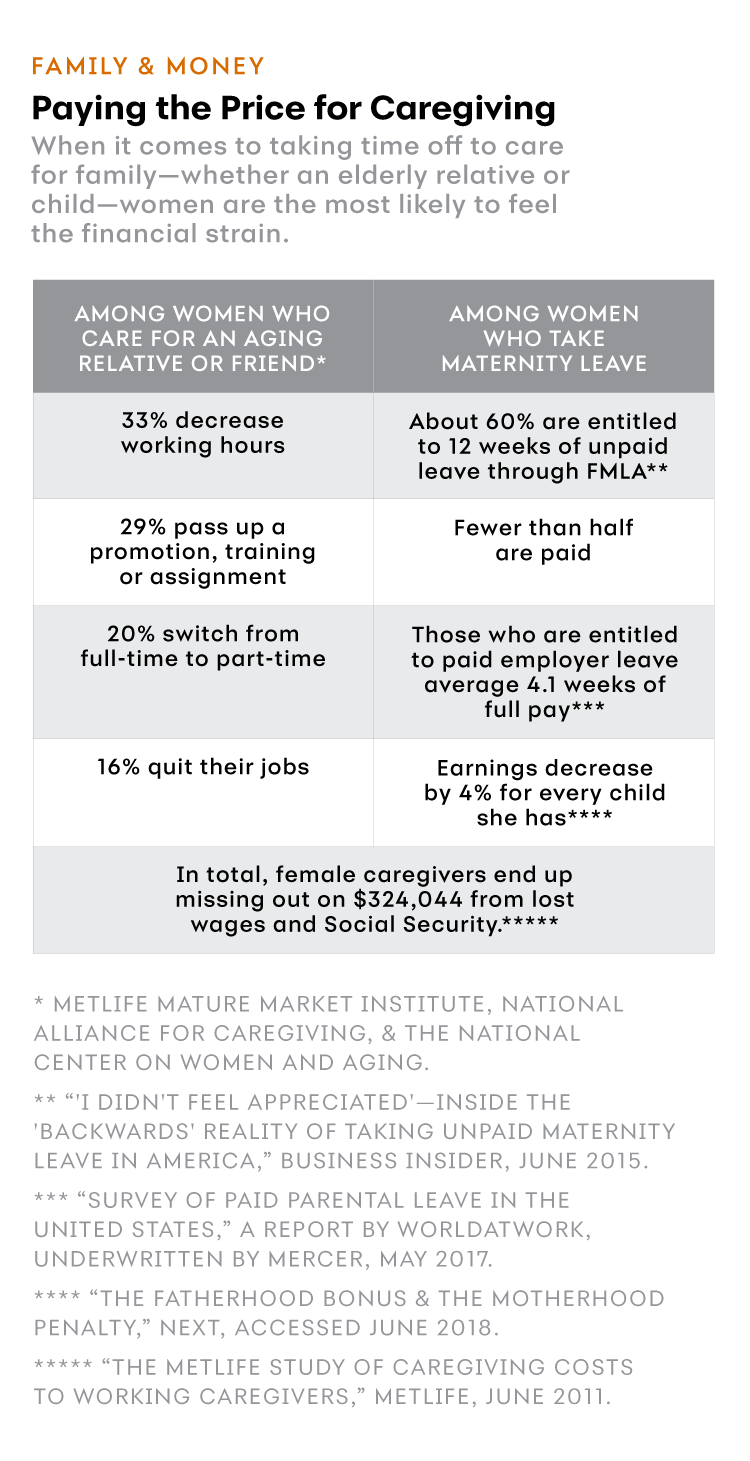

This chart is under the category "Family and Money" and the title is "Paying the price for Caregving." The introduction is "When it comes to taking time off to care for family—whether an elderly relative or child—women are the most likely to feel the financial strain. For women who care for an aging relative or friend, there are four statistics listed: a 33 percent decrease in working hours; 29 percent pass up a promotion, training or assignment; 20 percent switch from full-time to part-time; 16 percent quit their jobs. For women who take materinity leave, there are four statistics listed: about 60 percent are entitled to 12 weeks of unpaid leave through FMLA; fewer than half of those are paid; those who are entitled to paid employer leave average 4.1 weeks of full pay; earnings decrease by 4 percent for every child she has. There is one statistic for both groups: In total, female caregivers end up missing out on $324,044 from lost wages and Social Security.

A former Wall Street Journal reporter and Inc. magazine editor, Simona has reported and written on an array of business and financial topics including investing, leveraged finance, business strategy and business planning. She has interviewed everyone from Fortune 50 CEOs to traders to private equity investors.

- https://www.aarp.org/content/dam/aarp/livable-communities/learn/health/metlife-study-of-caregiving-costs-to-working-caregivers-2011-aarp.pdf

- http://content.thirdway.org/publications/853/NEXT_-_Fatherhood_Motherhood.pdf

- https://www.businessinsider.com/the-reality-of-unpaid-maternity-leave-in-america-2015-6