Student Loan Forgiveness Updates: Top Questions Answered

Everything you need to know about the new student loan forgiveness plan—and smart ways to use the funds if you qualify.

Everything you need to know about the new student loan forgiveness plan—and smart ways to use the funds if you qualify.

Here are key discussions you should have with your future spouse.

Make any buyout offer work for you.

A new interest rate could benefit your bottom line or cost you.

With more money coming in, you have more options to save and invest.

A little money each day adds up to a lot.

Mindful spending to save money.

Cut your budget to start your emergency fund.

What you need to know about money and death.

Here’s how to stop ruing the day you made that money mistake and how to avoid doing the same thing again.

Rolling with your financial ups and downs requires a holistic approach.

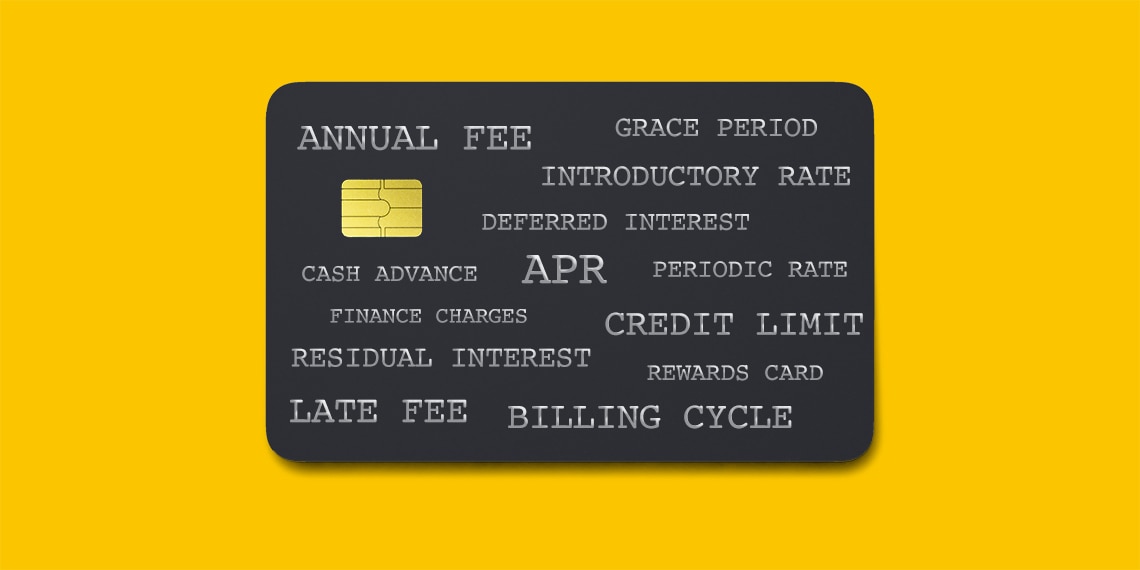

Get these facts and more in this guide to credit card basics.

Think about your dollars as we all step back into the world.

It’s the reason why you’re paying more for everything. Here’s what you need to know—and how to fight back.

Apply the lessons and insights of the past to your future.

Improving your financial situation doesn’t have to take a lot of time. Here’s how to do it efficiently.

Your new start will come with consequences.

Set your financial future off on the right foot.

It may be the key to balancing your budget.

A map of the United States with travel symbols and dollar signs.

10 small financial wins that could transform your future.

Got some money saved? One of these communities could be an ideal fit for you.

Reset your budget with these 14 tips.

The CPI can help you budget smarter.

How to save money like your favorite superheroes save the world.

Make a smarter budget so you can stick with it.

After a break in employment, it’s important to get back into the groove of saving and paying down debt. Here’s how.

Put together a painless financial plan.

Use these tips to stay prepared.

Ready to manage and reduce your debt more effectively? Here’s how.

How lessons from a tough year can help you be more prepared and financially secure in the future

Pop quiz: Do you really understand all the terms in your credit card agreement? Think of this guide as your terminology refresher course.

Opening a savings account is a great start, but it’s just the beginning.

Everyone should understand the different kinds of financial risk.

These benefits—from tuition help to free fishing licenses—can put some real money in your pocket.

These essential financial lessons will help your young adult now … and in the future.

6 topics all couples should talk over.

Raiding your savings accounts for extra money can result in costs and complications.

Learn more about earning extra with a side gig and how you and your partner can tackle debt and have productive conversations.

Lowering your debt won’t be easy, but here’s how to begin the process—and stay on track.

The story of how this young professional bounced back after unemployment and found her financial footing offers lessons for us all.

Here are a few ways to see if you’re developing caviar tastes—and undermining your larger financial goals.

This young New York City man knows how to work hard to make his personal finances stronger.

Financial blogger Jamila Souffrant explains how.

Test your knowledge by taking our 10-question quiz.

Borrow wisely to help you attain important goals

Make sure you have this guaranteed coverage to protect your savings

Avoid running up debt to cover big expenses

Know where you are and decide where you want to go.

Five ways to feel more comfortable and empowered about money.

Discussing money issues with your spouse or partner can be difficult … and a little scary.

These are some steps women can take.

Learn which money skills you need to brush up on with this quiz.

Different spending personalities can still work together on finances.

Here’s how to make a love connection without overspending.

Don’t let money come between friends—and don’t let friendships wreck your financial goals.

This is how—with a little determination, hard work and the right tools—one college grad eliminated almost $65,000 in student loans in just five years.

Avoiding a few basic errors can set you up for a secure, strong financial future.

Just starting out in your career? Use these strategies to put money away to help you unlock future possibilities.

Here are a few ways to tackle college debt, while building toward bigger financial goals.