Secured vs. Unsecured Credit Cards: How Do They Work?

Pros and cons to consider, and tips to keep in mind.

Pros and cons to consider, and tips to keep in mind.

Learn what it is, how you use it and why you are charged interest.

Fostering financial empowerment: The role of credit education in the Hispanic community.

Understand how credit cards can build a positive credit history and increase your credit scores.

Learn about a score used to assess your creditworthiness.

Looking for the best cash back? Why programs aren't created equal.

What’s your grasp on scores, points and rewards?

Spending money is easy; spending it smartly can be hard.

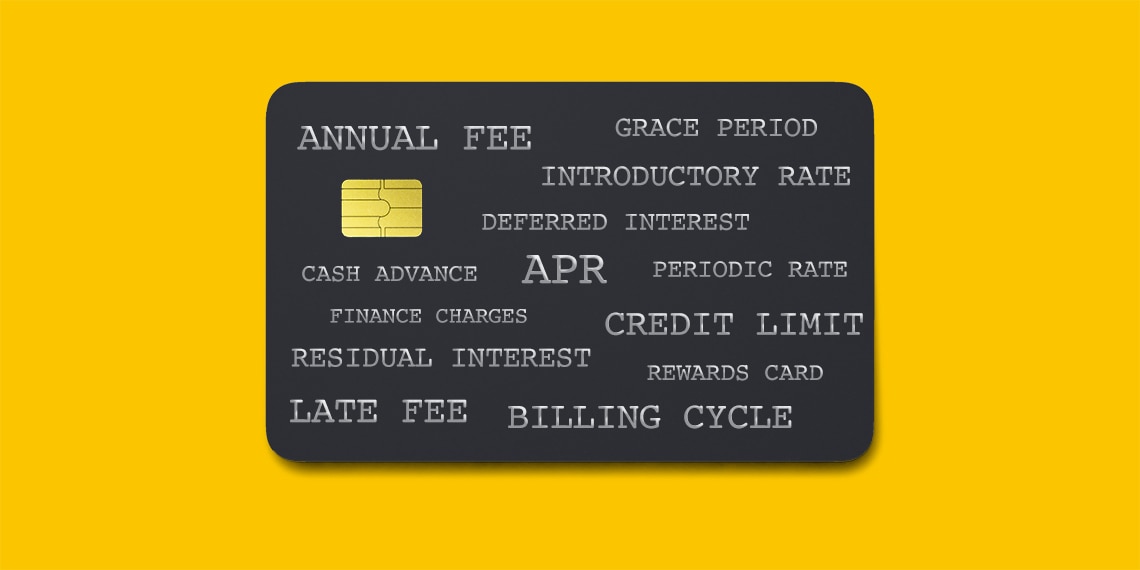

Get these facts and more in this guide to credit card basics.

Don’t ignore your credit card rewards program.

Choose the rewards that benefit your life.

Think about your dollars as we all step back into the world.

Improving your financial situation doesn’t have to take a lot of time. Here’s how to do it efficiently.

It may be the key to balancing your budget.

Navigating the many, many options for rewards and fees.

Learn the benefits of these popular credit cards.

Put together a painless financial plan.

Ready to manage and reduce your debt more effectively? Here’s how.

Pop quiz: Do you really understand all the terms in your credit card agreement? Think of this guide as your terminology refresher course.

The pandemic has spurred thieves to invent new ways of ripping you off. Here’s how to help protect yourself.

This little-known score can have a big impact on how service providers treat you.

See how credit cards saved the day for three savvy travelers when possible catastrophes struck.

All the basics in one easy-to-read place. Find out how credit scores work, why they matter, how to get started and tips for improving your credit scores.

Credit cards can offer benefits when you’re traveling, reward you for your spending habits or protect you if a purchase isn’t what you expected.

Data storage, wireless capabilities, parental controls and AI? All this is closer than you think.

Give your child the knowledge and good habits to handle a credit card successfully.

The answer depends on the time you have to devote to managing the cards, how the cards fit into your financial picture, and what you use them for.

Learn the differences to make informed decisions on which to use.

These tips will help you stay secure when you’re shopping or banking online.

Some early lessons about how credit cards work can help your kids make the most of their first card—and enjoy the opportunities that come with good credit.