The calendar has turned and the 1099s are rolling in. It’s time to file your tax returns. So just what is deductible in the gig economy?

This decision tree is titled "Business Travel Expenses." Do you use part of your home only for your business? If yes, do you rent or have a mortgage for that space? If yes, deduct It! Step one is to calculate the percentage of your home you use. Step two is to deduct that percentage of your rent/mortgage, mortgage interest, utilities and home insurance. If you don't use the room only for business, such as if it’s a dining room at night, it's not deductible.

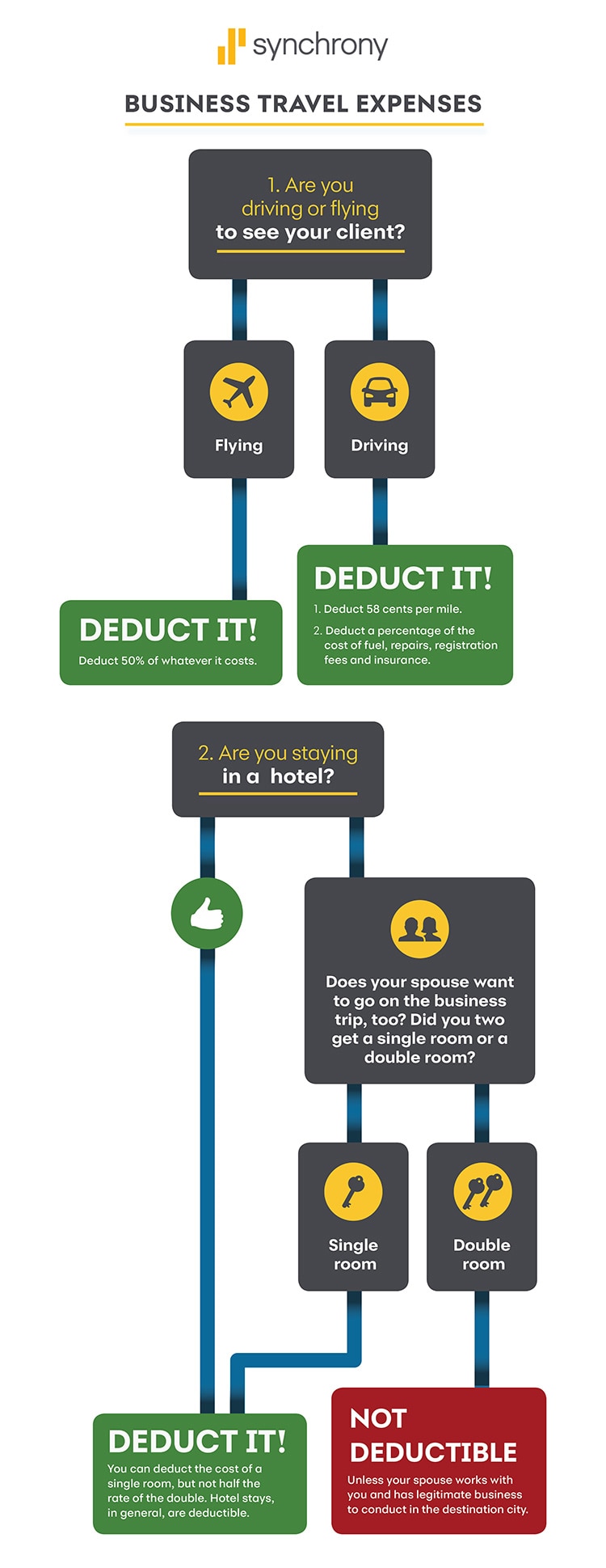

This decision tree is titled "Business Travel Expenses." There are two parts. Part one is "Are you driving or flying to see your client?" If you are flying, you can deduct 50% of whatever it costs. If you are driving, you can deduct 58 cents per mile, and a percentage of the cost of fuel, repairs, registration fees and insurance. Part two is "Are you staying in a hotel?" You can deduct the cost of a single room, but not half the rate of the double. Hotel stays, in general, are deductible. So if your wife is traveling with you, you can't deduct a double room unless your spouse works with you and has legitimate business to conduct in the destination city.

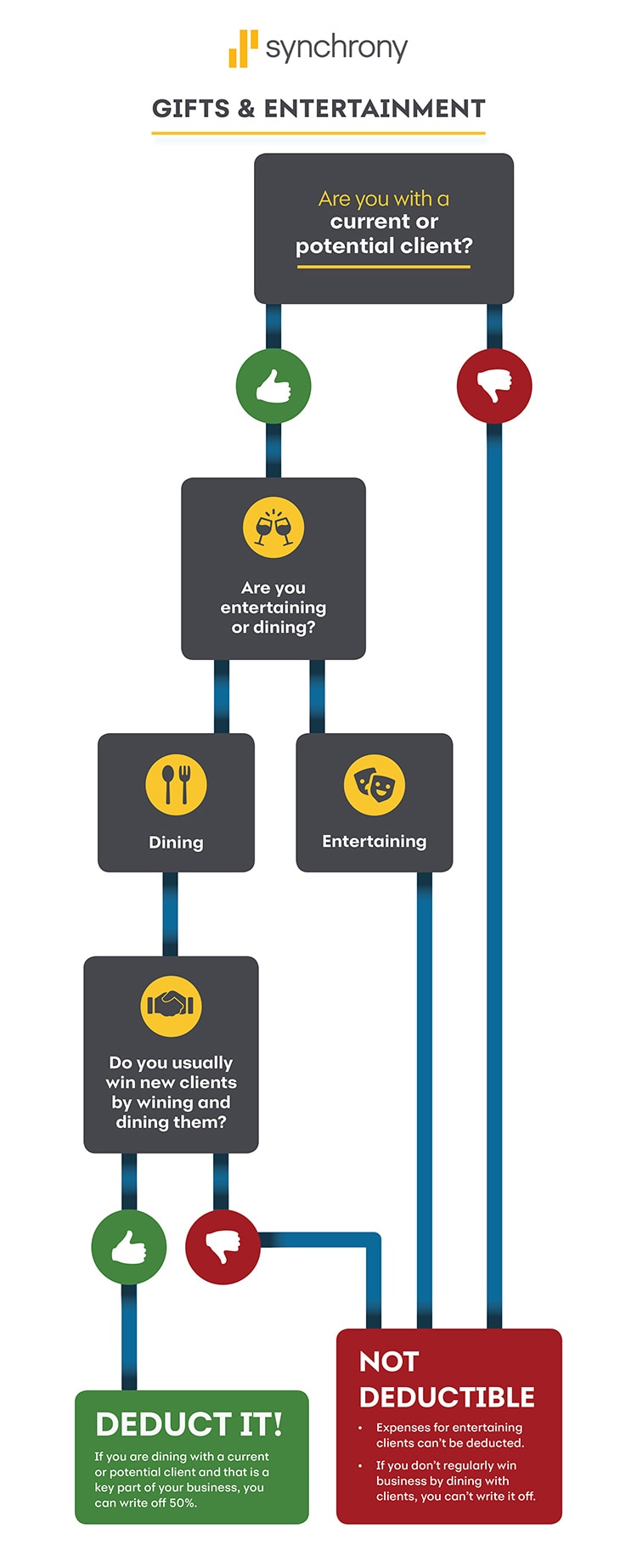

This decision tree is titled "Gifts & Entertainment." Are you with a potential client or a current client? Are you dining or entertaining? If you are dining with a current or potential client and that is a key part of your business, you can write of 50%. Expenses for entertaining clients can’t be deducted, and if you don’t regularly win business by dining with clients, you can’t write it off.

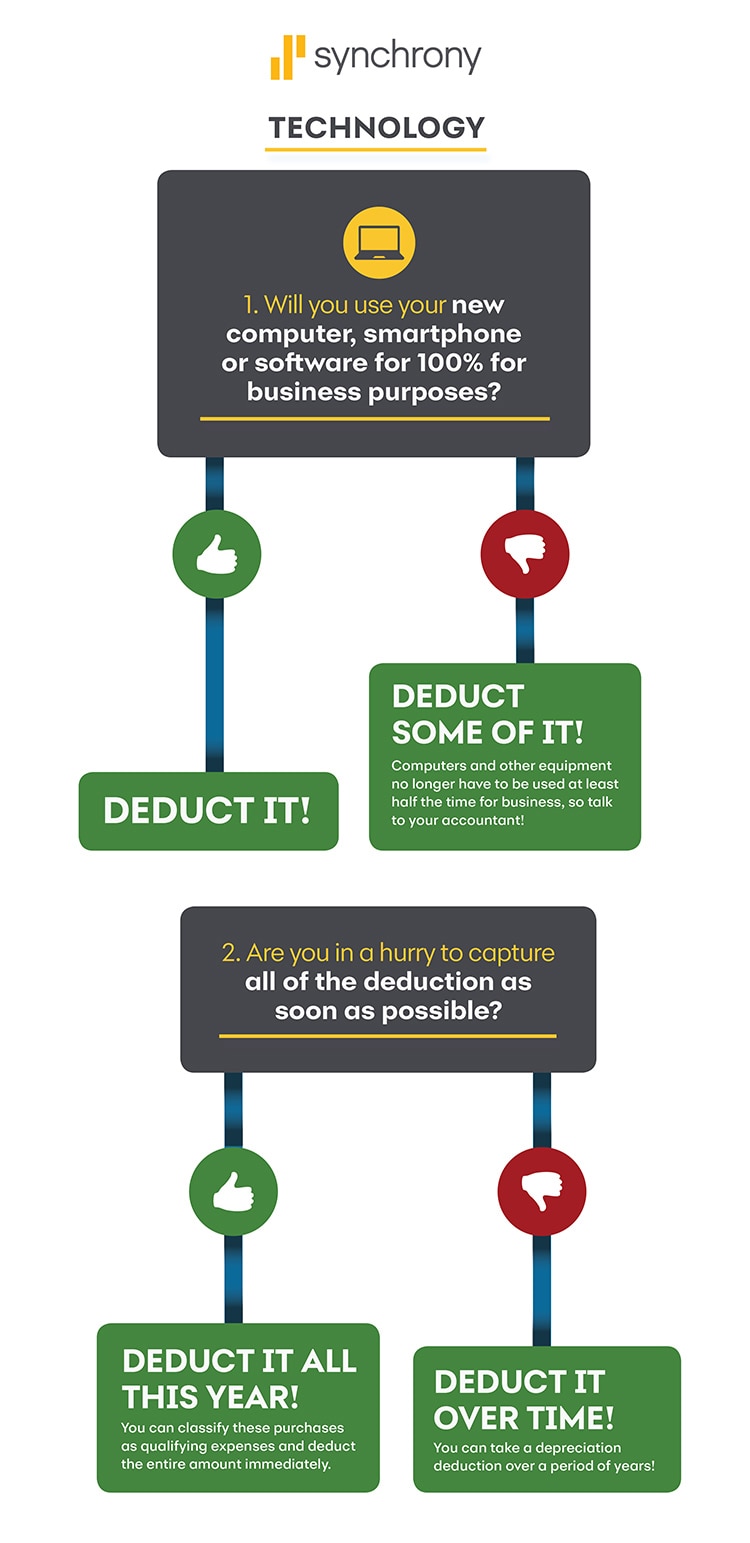

This decision tree is titled "Technology." Will you use your new computer, smartphone or software for 100% for business purposes? If so, you can deduct it. Or, if you are not, you can still deduct Some of It! Computers and other equipment no longer have to be used at least half the time for business, so talk to your accountant! Are you in a hurry to capture all of the deduction as soon as possible? You can classify these purchases as qualifying expenses and deduct the entire amount immediately, or you can take a depreciation deduction over a period of years.

Andy Sobel is a freelance writer and editor. He has held senior editing positions in The Wall Street Journal's New York and Brussels newsrooms and was managing editor of American Banker. A graduate of the University of Missouri and Union College, Andy now lives in Nashville, TN.

Learn about funding your retirement when you’re self-employed.

- https://turbotax.intuit.com/tax-tips/self-employment-taxes/a-freelancers-guide-to-taxes/L6ACNfKVW

- https://blog.freelancersunion.org/2018/12/03/tis-the-season-to-wrap-up-more/

- https://www.accountingweb.com/tax/business-tax/what-to-know-about-travel-expenses-for-freelancers

- https://www.moneyunder30.com/taxes-for-freelancers

- https://www.forbes.com/sites/kellyphillipserb/2018/12/14/irs-announces-2019-mileage-rates/#462a66af5e51

- https://www.investopedia.com/terms/s/section-179.asp

- https://blog.freelancersunion.org/2018/12/24/take-advantage-of-these-8-tax-saving-gifts-for-freelancers-before-the-year-ends/

- https://blog.freelancersunion.org/2018/10/22/happy-holidays-updated-meal/

- https://turbotax.intuit.com/tax-tips/small-business-taxes/mobile-phones-internet-and-other-easy-tax-deductions/L8dHBvBxu

- https://www.schgroup.com/resource/blog-post/2018-tax-roadmap-depreciation-changes-tax-reform/

- https://www.journalofaccountancy.com/news/2018/oct/tax-deduction-meal-entertainment-expenses-201819848.html