What’s the Difference Between Traditional and Roth Retirement Accounts?

• Traditional 401(k)s and Individual Retirement Accounts (IRAs) generally allow tax deductible contributions, and gains are tax-deferred—meaning you’ll pay income tax on withdrawals.

• Roth IRA and Roth 401(k) contributions are not tax-deductible, but earnings and qualified withdrawals are tax-free.

• Roth accounts are ideal for young investors who are likely to be in a higher tax bracket in the future. By passing up a tax break now, they may have the opportunity to claim a more valuable tax break later.

All retirement accounts are designed to encourage Americans to save for their future by offering some kind of tax break. The first such “qualified” accounts authorized by Congress let workers make contributions with pre-tax dollars. The money could grow, invested in stocks and bonds, tax-free. Individuals only paid income tax when they made withdrawals from these traditional accounts.

But in 1997, then-Sen. William Roth (R-Del.) proposed a retirement account that would allow after-tax contributions. Those contributions would also grow tax-free, but investors could retrieve that money from the account at any time without paying taxes. And they wouldn’t owe taxes on withdrawals of earnings either, as long as they waited until after age 59½. Roth reasoned that such accounts would appeal to young investors early in their careers who might be in lower tax brackets. Today, Roth accounts offer a powerful alternative way to save for retirement.

How Traditional Retirement Accounts Work

Traditional retirement accounts can offer tax-free contributions and investment gains, but you’ll pay income tax on withdrawals later. Over time, that tax-free growth can add up to a big nest egg.

When you reach age 70½, you usually must begin taking required minimum distributions (RMDs)—a percentage of the account value, based on age—every year. One exception: If you’re still working at age 70½, you don’t have to take RMDs from a current employer’s retirement plan until after you leave that job (unless you own 5% or more of the company).

There are two basic types of traditional retirement accounts: 401(k)s and IRAs.

Saving in a 401(k)

A 401(k) is usually sponsored by an employer, although self-employed people can set up what’s called a solo 401(k). In 2019, you can contribute up to $19,000, with another $6,000 in catch-up contributions if you’re 50 or older. Your total annual contribution, including any employer matching contributions, however, can’t exceed $56,000, or $62,000 if you’re 50 or older.

Employer matching contributions are essentially free money for you. Your company gets a tax break for its generosity, which also helps retain good workers. This type of compensation is often “vested,” which may mean you must stay at your job for a set period to collect the funds. While you always own the money you contribute, your employer’s vesting schedule may dictate when the matching contributions are yours to keep.

Withdrawals from a 401(k) before age 59½ will prompt a 10% penalty, with a few exceptions. For example, you can withdraw money from a current employer’s account penalty-free if you leave that job after age 55. And you can generally borrow up to half of your 401(k) balance, but no more than $50,000, and repay with interest.

Saving in a Traditional IRA

Anyone with earned income from a job can open an IRA, and you can invest the money in stocks, bonds, mutual funds, exchange-traded funds, and other approved investments. In 2019, the maximum yearly contribution to an IRA is $6,000, or $7,000 for those age 50 and older.

Those contributions are deductible unless you or your spouse are also enrolled in a retirement plan at work. In that case, the ability to fully deduct IRA contributions begins to phase out when income exceeds $64,000 for singles and $103,000 for married couples filing jointly.

Withdrawals from a traditional IRA before age 59½ also incur a 10% penalty. However, there are some exceptions. For example, you may withdraw up to $10,000 penalty-free for a first-time home purchase—although the withdrawal is still taxable. Other exceptions include qualified higher education bills and certain unreimbursed medical expenses.

Other more specialized IRAs for self-employed workers, known as SEP and SIMPLE IRAs, function as a sort of hybrid between IRAs and 401(k)s, with their own rules and limitations.

How Roth Retirement Accounts Work

Investments in Roth retirement accounts grow tax-free, just like traditional retirement accounts. But because contributions have already been taxed, your withdrawals in retirement are tax-free.

There are two basic types of Roth retirement accounts: Roth IRAs and Roth 401(k)s.

Saving in a Roth IRA

You can open and fund Roth IRAs in the same way as a traditional IRA. The annual limits are the same—$6,000 in 2019, and $7,000 if you’re age 50 or older. However, there are income limits that determine who can fund a Roth.

For example, in 2019, eligibility to contribute to a Roth IRA begins to phase out for single filers when their modified adjusted gross income (MAGI) exceeds $122,000 per year and is prohibited when it exceeds $137,000 per year. For married couples filing jointly, the phase out begins at $193,000 per year and is prohibited when MAGI exceeds $203,000.

After you’ve had a Roth IRA for five years, you can withdraw contributions (but not earnings) with no taxes or penalties—although it often makes more sense to keep that money invested for the future. You can withdraw any earnings in the account tax-free once you reach age 59½ and have held a Roth account for at least five years.

Saving in a Roth 401(k)

Also called a Designated Roth, these plans are sponsored by an employer. They have the same tax rules as a Roth IRA but with higher contribution limits. The contribution limits are the same as a traditional 401(k), and there are no income limits. Unlike with a Roth IRA, in most cases you cannot withdraw original Roth 401(k) contributions until age 59½.

Employers may also match your Roth 401(k) contributions. However, these matching funds must be put in a pre-tax account like a traditional 401(k), and you will owe income tax on this form of compensation when you make withdrawals in retirement.

Roth or Traditional: Which Is Right for You?

When deciding which type of account is right for your retirement savings needs, it’s important to consider the pros and cons of each.

Roth Pros

• No income tax on withdrawals in retirement.

• Tax rates are currently at historic lows, with the latest cuts set to expire in 2025. Future retirees may face higher income tax rates as a result.

• Flexible withdrawal rules mean a Roth can double as an emergency fund.

• No RMDs appeal to people who plan to leave assets to heirs.

Roth Cons

• No tax break on contributions.

Traditional Account Pros

• Contributions are tax deductible in the year you make them, lowering your current tax bill.

Traditional Account Cons

• Withdrawals are subject to income tax.

• Without careful planning, RMDs can bump retirees into a higher tax bracket.

Investors may want to consider using a mix of both types of accounts to allow for flexibility in withdrawals and tax planning when they retire.

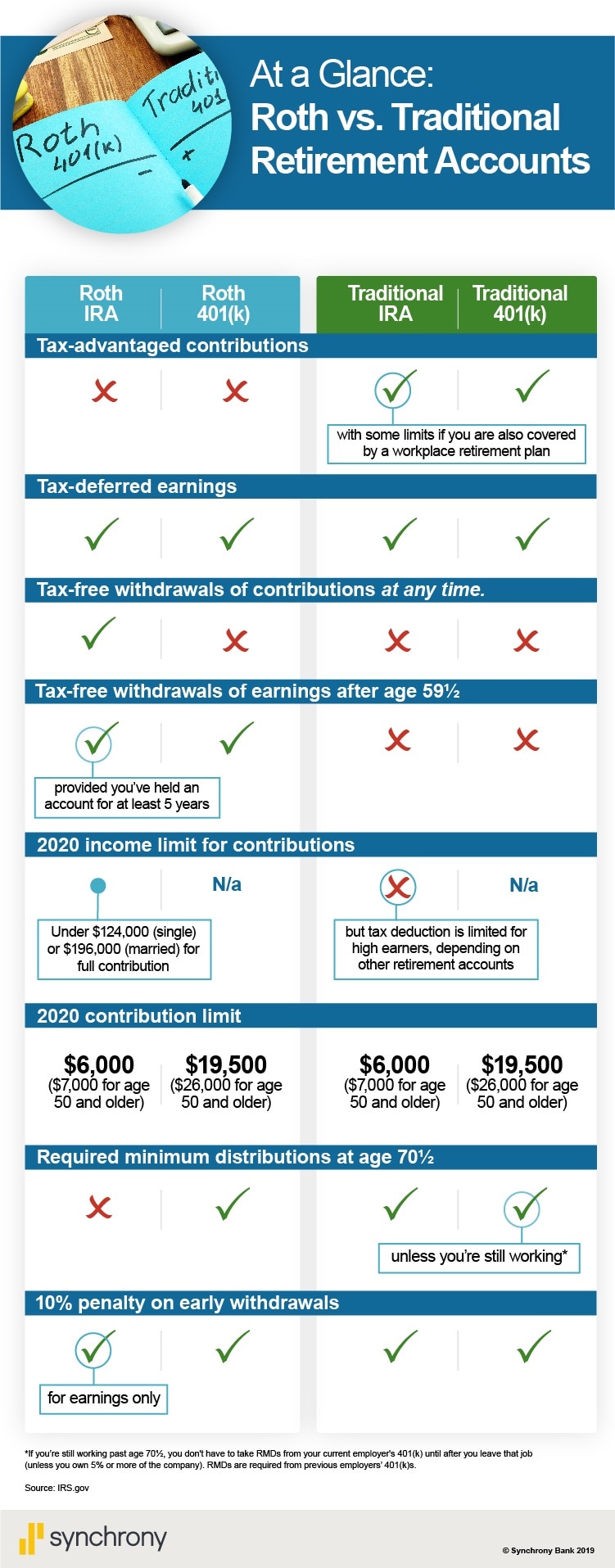

This chart is called At a Glance: Roth vs. Traditional Retirement Accounts. It compares the 4 types of retirement accounts in this article based on information available from IRS.gov. Roth IRAs and Roth 401ks do not provide tax-advantaged contributions, while traditional IRAs and 401ks do. There are some limits to tax advantaged contributions to traditional IRAs if you are also covered by a workplace retirement plan. All offer tax deferred earnings.

Marco Argento has written about personal finance for more than 30 years.

If you work for yourself, learn more about your options for self-employed retirement accounts.