What Are Self-Employed Retirement Plans?

• Self-employed retirement plans allow people who work for themselves to access tax-advantaged retirement savings accounts.

• Depending on the account, contributions to self-employed accounts (up to certain limits) grow tax-free or tax deferred.

• Investors can choose a plan based on their income and individual savings goals.

If you’re self-employed, you don’t have the opportunity to take advantage of an employer-sponsored retirement plan. That doesn’t mean you lack options for setting aside tax-advantaged savings, however. You actually have many similar options to save for retirement, including individual IRAs, 401(k)s, and other choices.

And if you’re both the business owner and its employee, some plans provide an opportunity to make retirement contributions as both an employer and an employee. The plans that will work best for you mainly depend on individual circumstances, such as how much your business earns and how far in the future you plan to retire.

Traditional vs. Roth IRAs

The simplest solution for individuals without access to an employer-sponsored retirement plan is to establish an individual retirement account (IRA). Traditional IRAs offer tax-deferred growth on investments, while Roth IRAs offer tax-free growth. Anyone with earned income can make contributions to these accounts up to an annual maximum amount established by the IRS. In 2019, those maximums are $6,000 for individuals under age 50 and $7,000 for those 50 and older.

The difference between traditional and Roth IRAs lies in when your contributions are taxed. Traditional IRAs can be funded with pre-tax dollars, which means your contributions may lower your taxable income. You also don’t pay taxes on any earnings while your funds remain in the account. After you turn 59½, withdrawals are subject to income tax. Withdrawals you make before you turn 59½ are subject to income tax and may trigger a 10% penalty except in certain circumstances. These exceptions include a first-time home purchase, qualified higher education expenses and certain unreimbursed medical expenses.

Contributions to Roth IRAs use income that has already been taxed. Unlike a traditional IRA, however, a Roth IRA allows you to withdraw your funds tax-free if you’re over 59½ and have held a Roth for at least five years. You can also withdraw your contributions penalty-free at any time—but you will usually have to pay penalties for withdrawing earnings before you turn 59½.

Traditional IRAs also require you to take minimum distributions (RMDs) once you reach age 70½. Roth IRAs do not compel distributions, but you can only contribute to a Roth IRA if your income is below a certain level. In 2019, only single filers with modified adjusted gross income (MAGI) of less than $122,000 or married joint filers with MAGI of less than $193,000 can contribute the full amount to a Roth IRA. Contributions phase out entirely when you reach $137,000 if single or $203,000 if married filing jointly.

When to Consider SEP IRAs

Simplified Employee Pension (SEP) plans are a good option for a small business with only a few employees or a self-employed owner who generally makes a nice profit.

Employees can’t contribute to the plan, but you as the employer can contribute up to 25% of your net income, to a maximum of $56,000 in 2019. You can make contributions for your employees, but whatever percentage you select, you must contribute the same percentage of compensation for each employee.

If your profits are high enough, you could potentially make much higher contributions to a SEP plan than a traditional IRA would allow—although you may contribute to both if you’re self-employed. And if your business typically produces low profits, you may have other options that let you contribute more.

How SIMPLE IRAs Work

Savings Incentive Match Plans for Employees (SIMPLE IRAs) are retirement plans specifically designed for small businesses. Where a SEP plan only allows employer contributions, SIMPLE IRAs allow both employees and self-employed owners (the employer) to contribute to the plan.

Employees can contribute up to $13,000 in 2019 ($16,000 if they’re 50 and older). Employers must choose one of two methods to calculate the minimum contribution they must make on behalf of employees:

• Matching employee contributions up to 3% of the employee’s total compensation (which can be reduced to 1% in any two out of five years).

• Contributing 2% of employee compensation for all eligible employees, regardless of whether the employees make contributions themselves—up to $5,600 in 2019.

As a self-employed person, you may act as both employee and employer. This means you may contribute the individual limit of $13,000 or $16,000 on your own behalf. And you may receive an employer contribution of the same type and rate as the contributions you make for employees (with some limits). In 2019, if you and your business earn enough money, you could contribute up to $26,000 to a SIMPLE IRA if you’re under 50, or $32,000 if you’re 50 and older.

How Solo and Individual 401(k) Plans Work

A solo 401(k), also known as an individual 401(k) or a one-participant 401(k), is designed for self-employed people and business owners whose only employees are spouses. These types of plans may allow you to save more for retirement than you could in a traditional IRA or even a SEP IRA, while avoiding the expense and paperwork of setting up a full traditional 401(k) plan.

As with SIMPLE IRAs, you can contribute to a solo 401(k) both as an employee and as an employer. For instance, you can contribute up to $19,000 for 2019 as an employee (or $25,000 if you’re 50 or older), even if that amount is 100% of your self-employed earnings for the year.

In addition, you effectively can contribute up to 25% of your net self-employment income as a sole proprietor. Total contributions max out at $56,000 in 2019 or $62,000 if you’re 50 and older. There are traditional and Roth versions of these plans—and you’re allowed to split your contributions between the two types.

How to Choose a Self-Employed Retirement Plan

Whether you work alone or employ others, it’s a good idea to maximize your retirement contributions if you can. While SEP and 401(k) plans offer the potential for higher maximum contribution levels than other types of plans, that doesn’t necessarily make them the best option for your situation. The right plan—or mix of plans—for you will generally depend on these three factors:

• Whether you have, or expect to have, any employees.

• If you want employees to be able to contribute to a plan, too.

• Which is your higher priority—maximum contributions or simple administration.

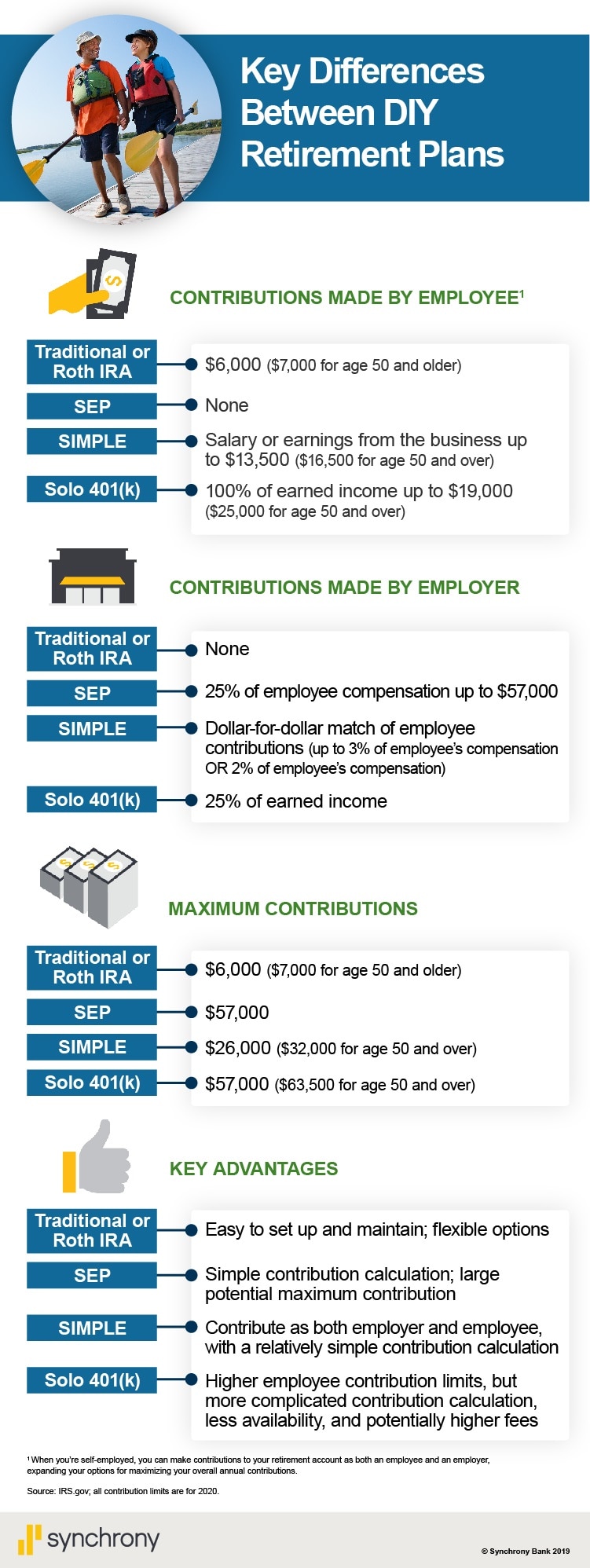

This chart is called Key Differences Between DIY Retirement Plans. When you’re self-employed, you can make contributions to your retirement account as both an employee and an employer, expanding your options for maximizing your overall annual contributions. This chart looks at SIMPLE, SEP, Solo and traditional or Roth IRAs. Its source is IRS.gov.

Matt Kuhrt writes about finance and health care and lives on the Maine coast.

Find out more about the difference between Roth and traditional retirement accounts.