What is Cyber Monday? A Guide to the Biggest Online Shopping Day of the Year

Expert tips to help you shop smart and save big. Don't miss out!

Expert tips to help you shop smart and save big. Don't miss out!

This is a tool that puts a wealthy retirement within your grasp. Here’s how it works.

Here's what you need to know about discussing money matters with your nine-to-twelve-year-olds during tough times.

Here are 10 ways to make that extra cash continue to work for you.

Changing your relationship with money can make all the difference. Use these tips to help create a more financially confident you.

Want to defer or even avoid paying taxes while growing your money? See why tax advantaged accounts might be the answer.

Learn how she built a hair empire that made her the first black female millionaire.

Energy bills tend to surge during the winter months, but we've got you covered with 15 ways to lower electric bill.

Want to lower your tax bill? A certified public accountant explains how itemizing these popular deductions on your return could help you save.

Follow these savvy tips to combat inflation and keep your savings safe.

In 2023, be one of the 9% of people who stick to their money resolutions with these helpful—and doable—tips.

A certified public accountant outlines her top tips for how to lower your tax bill before ringing in the new year.

Approaching 2023 with a fresh outlook on your money could make all the difference—and what better way to do it than with a New Year’s resolution or two?

Use this guide to keep your holiday budget off the naughty list.

Simple mistakes may be keeping you from maximizing your finances.

Here are some simple, enjoyable ways to stay on top of your finances during a rocky economy.

Buy less and enjoy more in college with these 40 tips that scrimp on cash but not fun.

Make any buyout offer work for you.

Families may not think the same way about money, savings and gifts.

With more money coming in, you have more options to save and invest.

When to seek help and when to fly solo.

A little money each day adds up to a lot.

Mindful spending to save money.

Cut your budget to start your emergency fund.

With America Saves Week just around the corner, we offer a few fun ways to help you reach your savings goals.

Improving your financial situation doesn’t have to take a lot of time. Here’s how to do it efficiently.

Which money skills do you have, and which ones need work?

Discuss the small details that can add up to a big bill.

How to save money like your favorite superheroes save the world.

Make a smarter budget so you can stick with it.

Could you change your own oil? These DIY tips could save you money.

With an automatic savings plan, you don’t need self-discipline to save each month—it happens for you. Here’s how it works.

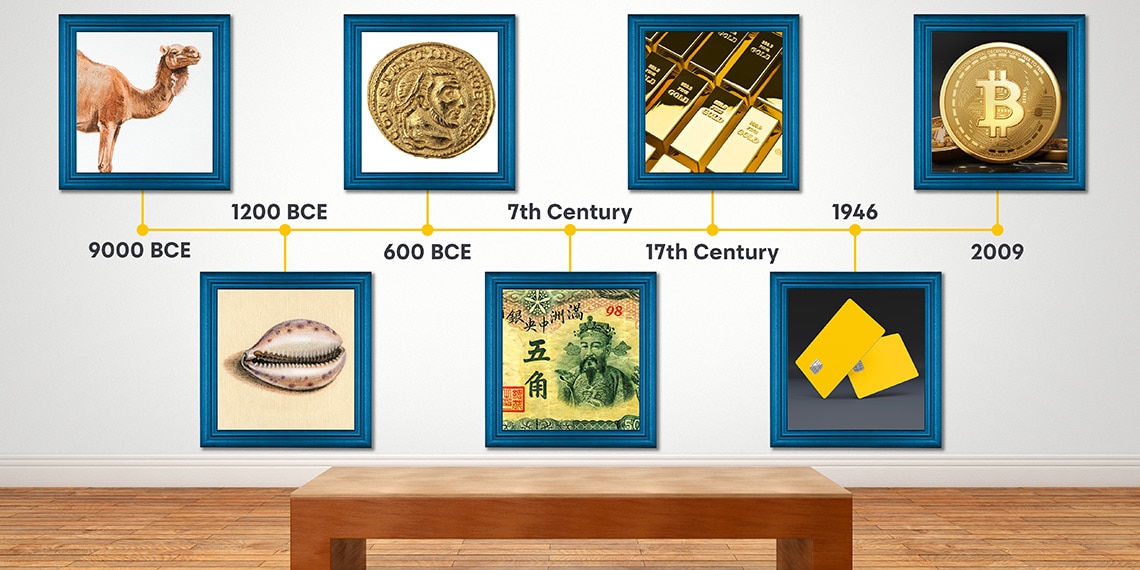

Five key developments in money’s long history that have given currency to currencies.

Opening a savings account is a great start, but it’s just the beginning.

From cars to televisions to furniture to travel, find out the best times of year to shop for everything on your list.

One young woman’s story of using the lessons she learned in childhood as motivation for her future.

Saving and investing more than half his banker’s salary helped Matt Ross launch a business that’s propelling him toward early retirement. His story offers some key lessons for all of us.

A focus on savings and smart investments has paid off for this young couple.

Turning saving into financial freedom wasn’t just a dream for this man—he’s making it happen.

A lifetime of work and saving helped this 57-year-old achieve her adventure dreams.

This couple found a way to save enough money to say goodbye to a life of full-time work.

Here’s how a lifelong interest in finance allowed one young author to retire before she turned 30.

There’s more to this generation’s finances than you might expect.

Want to retire early? Really early? Like in your 30s or 40s? Here’s how.

These years can be an incredible shortcut toward building wealth—if couples approach them the right way.

Want to retire in your mid-40s? Alex Tran is trying to make it happen.

The trip of a lifetime came after a year of saving.

In football and finances, winning over the long term depends on protecting what you have. Here's how to save defensively.

When you simplify your finances, you may find ways to save and invest more in order to reach your goals.

After wiping out their startup loan debt, these food truck entrepreneurs tackle funding their IRAs.

If you have multiple savings goals, this divide-and-conquer strategy can help you keep your financial house in order and get where you need to be.

Saving money for short-term goals can be easy, as long as you have structures and rules in place to keep you on track.

If you want to give to charities at the end of the year, consider starting your shopping in the early months.

The Alvarez family, grateful for newfound prosperity, donates to families in need.

Giving gifts to your family at the holidays can be enjoyable and memorable without breaking the bank.

How an expectant father saved up to buy the right vehicle for his future family.

To make lasting financial changes, break the hard-wired habits that stand in your way.

How a thirtysomething couple trimmed expenses and saved carefully to take a 10-day Hawaiian getaway without taking on debt.

This couple took a disciplined approach to build their backyard haven.

How one family stopped the gift-giving madness.

Stephanie Trombino’s family has a new way to celebrate.

Before you start shopping for the holidays, set yourself up for financial success.

She didn’t have a groom, but she still said “I do” to her dream wedding with a smart savings strategy.

Holiday travel is often stressful and expensive. Here are a few ways to reduce the cost—and the headaches.

Hosting the big holiday meal this year? Here are a few ways to do it for less money—and with less stress.

By taking advantage of an automated savings plan, Danielle Desir was able to buy her first home in just two years.

This is how—with a little determination, hard work and the right tools—one college grad eliminated almost $65,000 in student loans in just five years.

The way to reach some of your most ambitious savings goals can be as simple as a few minor changes to your daily money routines.