Today, the U.S. five-dollar bill features a portrait of Abraham Lincoln. But before Honest Abe’s first appearance on it in 1914, several others—including Andrew Jackson and Ulysses S. Grant—had graced its frontside. And it’s not just the design that’s changed. Thanks to inflation and rising prices, that five bucks is worth less every day—that is, unless you have a rare version of the bill, which is likely gaining in value as it ages.

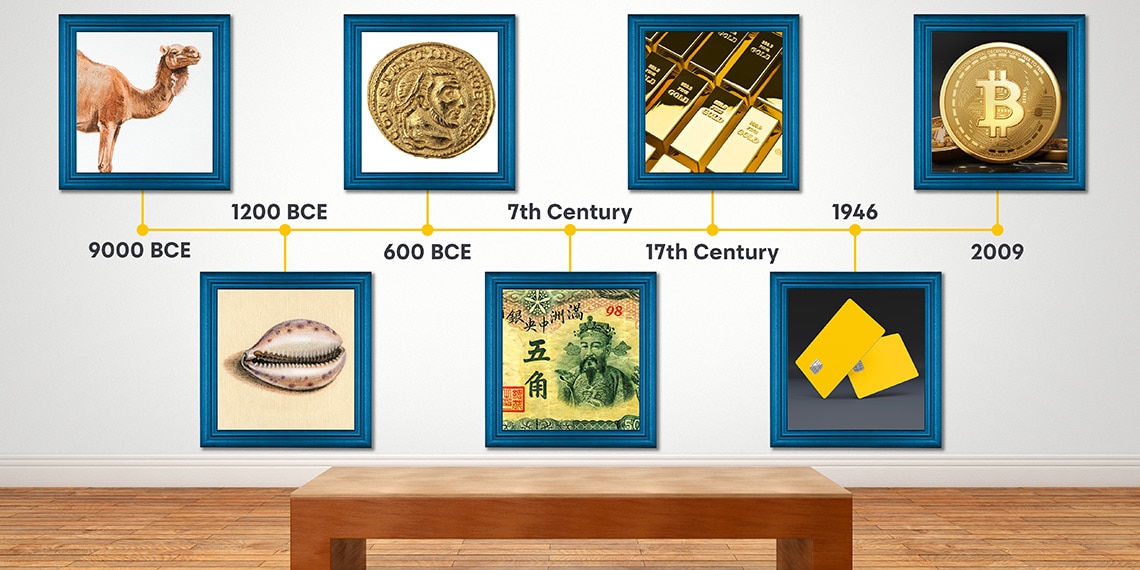

What we call “money” has always been a moving target. It changes appearance and value. So how did various currencies achieve, well, currency? How did a wave of your phone become a replacement for physical dollars? And what will money look like moving forward?

Here are five key developments in the history of money that have impacted how we earn, save and spend today.

Cash Cows

Before humans had money, they had stuff. In ancient times, when you had stuff other people wanted, you bartered it for stuff you wanted.

Around 9000 BCE, the most-sought-after commodities included things like cattle, sheep and camels. This was fine when people bartered close to home, but bulky creatures are cumbersome and difficult to transport. As people started to venture farther afield to trade, a more portable option became essential.

Flash forward to around 1200 BCE and enter cowries—the shells of marine mollusks plucked from oceans. Small, tough and shiny, they were recognized as precious, and their use spread across Asia, Africa, Oceania and Europe. Having been in use for some 10,000 years—even into the 20th century in some places—cowries win the prize as the world’s longest-running currency.

Three Coins in the Fountain

The issue with bartering became assigning value: Just how much was a cowrie or a cow worth? So, as pillagers pillaged and settlers settled, agreeing on the value of money became essential. It was the Lydians, who lived in what is now Turkey around 600 BCE, who get credit for a critical step in this process: fashioning the first known coins, made of a gold and silver alloy called electrum.

The metal used to make a coin—along with its weight—was important, as it denoted the money’s value. And as coins gained traction, so did the idea of adorning them with locally inspired designs—everything from Greek gods to familiar plants. Coins were money, but they now doubled as a historic record. Eventually, they took on even more uses: People flipped them to make decisions and tossed them into wells while making wishes. They may be used less in 2020, but coins have been an integral part of our culture for centuries.

The Paper Chase

Coins were obviously lighter and easier to transport than cows, but toting around bags of heavy metal still wasn’t very practical.

China’s Tang Dynasty, which began in the seventh century, came up with a smart solution. Paper money was like having a doctor’s note, but from the government. And instead of getting you out of school or work, it promised a certain amount of purchasing power. It was super-light and could feature even richer designs than coins.

Word spread, especially after it caught Marco Polo’s eye during his 13th-century visit to China. It’s believed that paper money reached the shores of what would become the United States in 1690, in the forward-thinking Massachusetts Bay Colony.

Gold Rush

Even the best ideas don’t come without speed bumps, though. For starters, counterfeiters had a heyday with paper bills. The bigger problem came when governments faced economic crises; it was far too easy to print more paper money, which led to skyrocketing inflation. Paper needed a backup—something universally valued yet not easily replicated.

Something like gold.

The “gold standard” let governments create a fixed price for this precious metal that was tied directly to the value of their currency. In the United States, the idea took root in the late 17th century, and it spread to Europe in the 19th century. But confidence in the gold standard crumbled during World War I, and it soon became apparent that in order to thrive, currencies needed the freedom to fluctuate dynamically against each other. The gold standard was dropped in the United States in 1933, and a global economy started to take shape.

The E-Buck Stops Here?

Cows, cowries, coins, paper, gold: Money has always had a physical presence. But today, it is quickly evolving into numbers that float through the ether.

This modern era of money began in 1946 with the first bank-issued charge card. Credit cards followed some 12 years later. Now, of course, swiping isn’t even necessary: Credit card numbers live on laptops, in mobile apps, on bracelets and in watches. They’ve become the new wallet, activated by a wave of the wrist or a flash of the phone screen.

These new-fangled wallets are still holding old-school dollars. The rise of cryptocurrencies like Bitcoin have been technology-forward efforts to shift—once again—the world’s definition of “money.”

Now, social media companies and entire countries are considering digital currencies of their own. Meanwhile, artificial intelligence is growing ever-smarter, and perhaps one day soon your budget and expenses will be managing themselves. The debate rages about exactly where we’re headed, but with history as our guide, the one thing we can absolutely count on is the inevitability of change.

Rich Beattie is a former executive digital editor of Travel + Leisure and has written for outlets such as The New York Times, Popular Science, New York Magazine and SKI.

Read next: Investing Terms Everyone Should Know