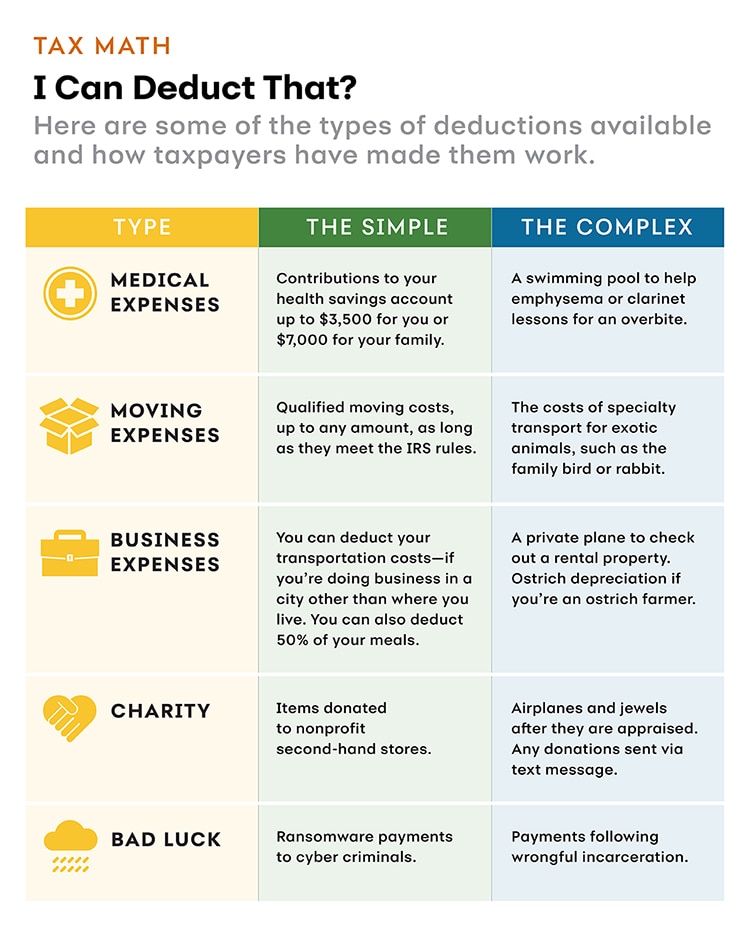

Due to the changes recently enacted in the tax law, the increase in the standard deduction will mean that fewer taxpayers will itemize their deductions. But those who do are likely exploring their options and looking for new deductions they may have missed. Here are some of the types of deductions available and how taxpayers have made them work.

This chart is in the category "Tax Math" and is titled "I Can Deduct That?" The introduction reads, "Here are some of the types of deductions available and how taxpayers have made them work." For Medical Expenses: The simple: Contributions to your health savings account up to $3,500 for you or $7,000 for your family. The complex: A swimming pool to help emphysema or clarinet lessons for an overbite. For Moving Expenses: The simple: Qualified moving costs, up to any amount, as long as they meet the IRS rules. The complex: The costs of specialty transport for exotic animals, such as the family bird or rabbit. For Business Expenses: The simple: You can deduct your transportation costs—if you’re doing business in a city other than where you live. You can also deduct 50% of your meals. The complex: A private plane to check out a rental property. Ostrich depreciation if you’re an ostrich farmer. For Charity: The simple: Items donated to nonprofit second-hand stores. The complex: Airplanes and jewels after they are appraised. Any donations sent via text message. For Bad Luck The simple: Ransomware payments to cyber criminals. The complex: Payments following wrongful incarceration.

Marcia Lerner lives in Brooklyn, NY, and writes about finance, health care and children's literature. Her articles and reviews have appeared in the New York Times and Proto magazine, as well as many financial websites and magazines.

Learn more about tax code changes that may affect your savings.

- https://www.irs.gov/taxtopics/tc502

- https://www.kiplinger.com/slideshow/taxes/T054-S011-tax-breaks-deductions-you-won-t-believe-are-real/index.html

- https://www.efile.com/legitimate-tax-breaks-and-unusual-extraordinary-qualified-tax-deductions-and-tax-exemptions/

- https://www.irs.com/articles/can-breast-implants-be-claimed-tax-deduction

- https://www.irs.gov/newsroom/tax-benefits-for-education-information-center

- https://www.thebalance.com/donation-value-guide-2018-4172778

- https://www.wisebread.com/surprising-charitable-tax-deductions

- https://www.accountingtoday.com/list/the-most-outrageous-tax-deductions-of-2017

- https://www.irs.gov/individuals/wrongful-incarceration-faqs

- https://www.irs.gov/taxtopics/tc419