When you find yourself in the enviable position of having extra cash, one of the first questions is: What to do with it? While your impulse may be to spend it on something enjoyable and unnecessary, there’s a voice of practicality somewhere in your mind, urging you to put it to good use. You should listen to that voice.

If you’re a homeowner, you might take advantage of the windfall to pay down your mortgage. Or you might consider saving the money in a certificate of deposit (CD) or high yield savings account, which are both great options. The following considerations can help you figure out which choice to make.

1

Savings returns vs. your mortgage rate—don’t forget taxes

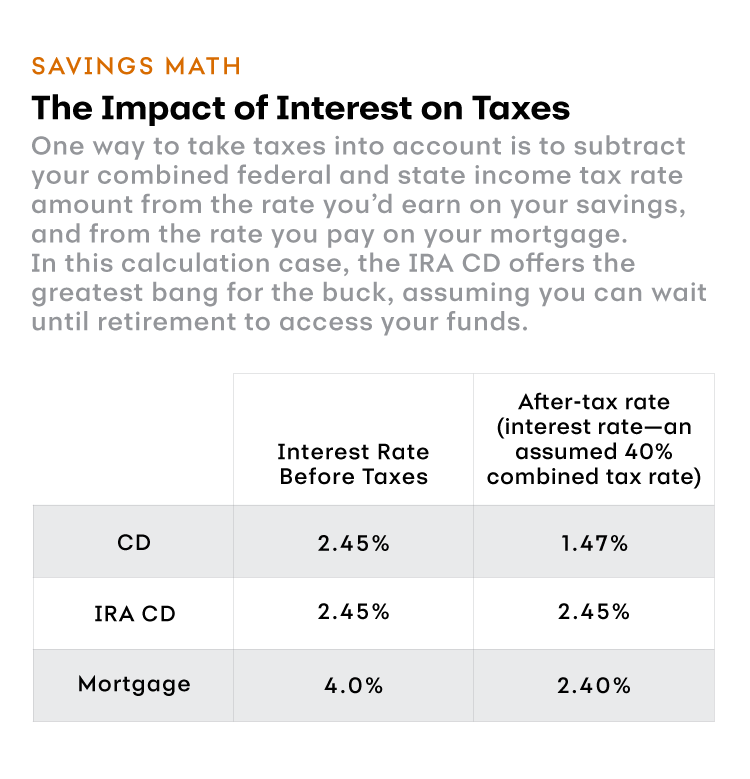

At first blush, it would seem that if you’re paying a higher interest rate on your mortgage than you can earn in an FDIC-insured savings vehicle, then you should pay down the mortgage. But it’s not that simple. When comparing your options, remember to also take taxes into account.

Paying down your mortgage can increase your tax bill if you currently itemize your deductions, because you won’t have as much mortgage interest to deduct. Saving in a regular high interest savings account or CD also can boost your taxes, because the interest you earn in them is taxable. On the other hand, interest earned on an IRA CD or IRA money market account isn’t taxed each year.

2

Liquidity

Another consideration is that when you use extra cash to pay down your mortgage, you lose access to that money (until you sell your house). CDs offer greater liquidity, but typically require specific holding periods. High yield savings accounts or money market accounts are highly liquid, and therefore might be the best choices if you anticipate needing access to your money in the near future.

3

Life phase

Paying off a mortgage while you’re still working can significantly reduce your expenses in retirement. And the mortgage interest deduction tends to be less valuable later in life. Interest may make up a smaller portion of your mortgage payments than it used to, and you might be in a lower tax bracket after you retire. So if you’re approaching retirement, consider putting extra money toward your mortgage.

4

A potential move

If your house has appreciated in value and you’re considering moving, you may have enough equity to pay off the mortgage when you sell—so it might not make sense to pay off the loan now. Instead, consider saving that cash.

If you’re facing the decision of where to put money you’ve saved, you’re already doing something right. So congratulate yourself for your financial prudence, and be sure to consider all the factors in your life when making the best possible choice.

This chart is titled "The Impact of Interest on Taxes" One way to take taxes into account is to subtract your combined federal and state tax rate amount from the rate you'd earn on your savings, and from the rate you pay on your mortgage. If a CD has a before tax interest rate of 2.45% and an after tax interest rate of 1.47%, an IRA CD has a before tax interest rate of 2.45% and an after tax interest rate of 2.45% and your mortgage has a before tax interest rate of 4% and an after tax interest rate of 2.4% the IRA CD is the best bet. This example assumes a 40% combined tax rate.

Austin Kilham is a Los Angeles-based writer and editor with a focus on personal finance, retirement, business and investing.