An unanticipated tax bill can be more than a disappointment—it might even derail your financial plans and delay your goals. If you’ve found yourself owing Uncle Sam a hefty sum this year, take solace; there are proven ways to better prepare for next year’s taxes.

You already know the basics—your tax rate is a percentage of your income. So, if you expect to have a similar income and similar expenses in 2019, how can you emerge with a different tax bill?

First, make sure that you’ve set the appropriate amount of tax to be withheld from each paycheck. Increasing the amount you withhold reduces the chances of a painfully large end-of-year tax bill. Then, look at the two main ways to reduce your tax bill: deductions and credits, which both pare down the amount of tax you owe. As with all tax matters, consult a tax professional about the particulars of your situation.

Step 1: Consider Tax-Advantaged Retirement Plans

One way to shrink your taxable income and do your future self a favor is to set aside money in a tax-advantaged retirement plan, either through a workplace plan or a traditional IRA. These plans are “tax-advantaged” because the money you put into it isn’t taxed now, so a contribution reduces your taxable income.

For instance, if you have a yearly income of $100,000, your income tax is calculated based on that amount. But if you set aside $5,000—5% of your income—in a traditional IRA, you reduce your taxable income to $95,000, meaning you would pay less in taxes for this year. The $5,000 contribution can grow in your IRA until you withdraw it in retirement. Contributing to your IRA every year will help build your retirement nest egg.

For 2019, the yearly limit on IRA contributions is $6,000, while for workplace plans like a 401(k) or 403(b), the contribution limit is $19,000. Keep in mind, you will pay taxes on the money in a traditional IRA when you withdraw these funds—meaning, in retirement. (With a Roth IRA, on the other hand, you get the tax-break in the future—you pay taxes now, but not in retirement.) Because of the penalty for early withdrawal, which would be before the age 59½, the money is most effective if you think of it exclusively as retirement savings.

Step 2: Maximize Deductions

As you may have noted on your 2018 tax return, the Tax Cuts and Jobs Act of 2017 increased the standard deduction. As a result, many people who had previously itemized deductions have opted for the standard deduction, which will be $12,200 in 2019, for single taxpayers. You can still itemize deductions if they are likely to add up to significantly more than this, but as usual you can’t both claim the standardized deduction and itemized deductions—it must be one or the other.

Also remember that deductions lower your taxable income. So a $1,000 deduction doesn’t translate to $1,000 off your tax bill. Rather, it means that your taxes will be calculated on a smaller—by $1,000—income.

If, however, you chose the standard deduction for your 2018 taxes, and you’re looking for a different outcome for your 2019 filing, you might want to consider itemized deductions like the following:

- Charitable Donations: You can deduct contributions to a qualified charity—up to 60% of your income, including the value of items you donate. And if you donate more than you can deduct, you can claim the “excess donation” deduction the following year, for up to six years.

- Health Savings Accounts (HSAs) and Some Medical Expenses: If you have a tough medical or dental year in 2019, you can deduct the expenses if they reach 10% of your adjusted gross income (AGI). This includes direct medical costs and also travel to medical appointments and some necessary treatments.

- State and Local Taxes: For individuals filing singly, you will be able to deduct state and local taxes up to $5,000. That amount might make itemizing your deductions add up to more than the standard deduction.

- Some Mortgage Interest: If you’ve taken out a second mortgage on your home, you can deduct some of the interest, but there are caveats. To qualify, the money from the loan must be used for something that improves the value of your home. In addition, the amount of the loan must not exceed $750,000.

- Student Loan Interest: If your modified adjusted gross income (MAGI) is less than $80,000 in 2019, you can deduct up to $2,500 of the interest you pay on a student loan used for higher education.

Step No. 3: Use Credits

Tax credits directly reduce the amount of tax you have to pay. Some credits are “refundable,” meaning that if you owe no tax, you can be paid the amount of the credit as a refund. Here are a few areas where credits might affect next year’s tax bill.

- Saving money: If you saved money in a retirement account in 2018, you may be eligible for the Saver’s Credit. Income limits apply—for single filers, you need to earn less than $32,000 per year; for married and filing jointly, less than $64,000.

- Raising kids or having dependents: One of the big changes to the tax system is the increased Child Tax Credit. There are income limits—the cap is $200,000 for single filers and $400,000 for married couples filing jointly—but the credit can be significant: $1,000 to $2,000 per qualifying child.

- If you’re supporting older children or others, you can get a credit for them as well, with the Credit for Other Dependents.

- If you have dependents (children under 13 or disabled spouses or others) and your income is $43,000 or below, you may qualify for the Tax Credit for Child and Dependent Care Expenses, which can be worth between 20% and 35% of the dependent care expenses you pay in 2019.

- For low- and middle-income families with children, one credit that can make a real difference is the Earned Income Tax Credit, a refundable tax credit that increases depending on how many kids you have—up to $6,557 if you’re married, filing jointly, and you have three or more qualifying children. You can get the credit if you don’t have kids, it’s just significantly less.

- Education costs: Interested in furthering your education or career training? It can help next year’s tax bill.

- The American Opportunity Credit can provide you with up to $2,500 of the cost of tuition (plus some fees) and course materials for colleges, universities or trade schools. But there are income limits. And 40% of that credit is refundable, up to $1,000.

- The Lifetime Learning Credit is not refundable, but it can offer a credit of 20% of the first $10,000 of qualified education expenses, up to a maximum of $2,000 per return; however, there are income restrictions.

As the saying goes, taxes are a certainty. But if you go through the process carefully by withholding appropriately through the year, filing on time to avoid fines and penalties and keeping track of potential credits and deductions, you should have a chance of a smaller tax bill next year. A tax professional can be very helpful in this process—consider consulting one sooner rather than later to avoid unpleasant surprises next year.

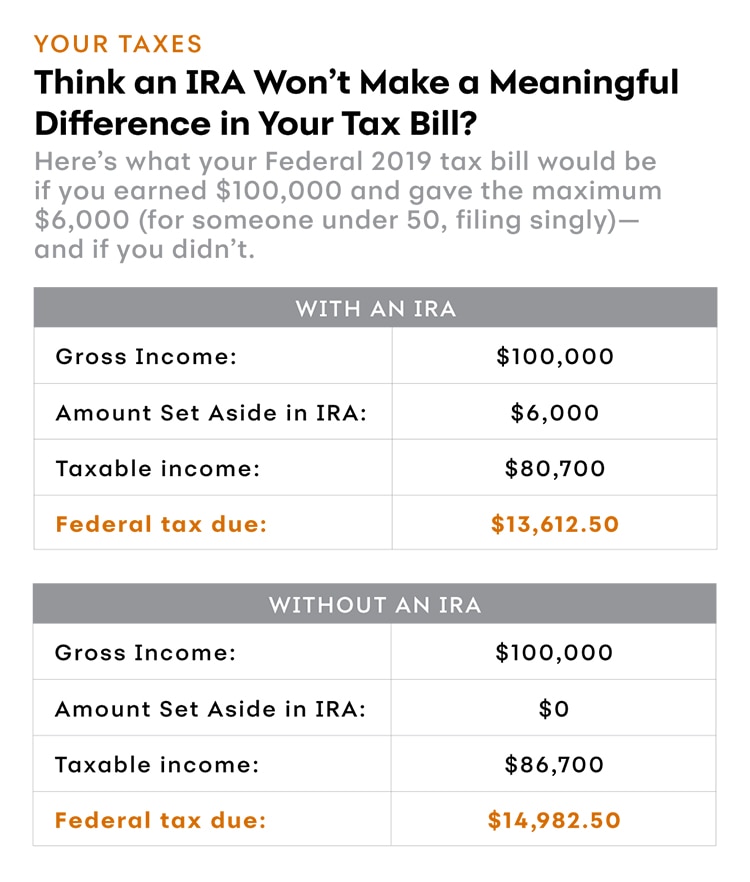

This chart is under the category "Your Taxes" and it is titled "How an Individual Retirement Account Can Change Your Tax Bill—and Your Future." There is an introduction and then two categories: with an IRA and without an IRA. The introduction reads: "Think an IRA won’t make a meaningful difference in your tax bill? Here’s what your Federal 2019 tax bill would be if you earned $100,000 and gave the maximum $6,000 (for someone under 50, filing singly)—and if you didn’t." First, with an IRA: Gross Income: $100,000; Amount Set Aside in IRA: $6,000; Taxable income: $80,700; Federal tax due: $13,612.50. Second, without an IRA: Gross Income: $100,000; Amount Set Aside in IRA: $0; Taxable income: $86,700; Federal tax due: $14,982.50.

This chart is based on calculations from a tax calculator and does not include itemized deductions or any tax credits. See a tax professional to see how an IRA could benefit your taxes.

Marcia Lerner lives in Brooklyn, New York, and writes about finance, health care, and children’s literature. Her articles and reviews have appeared in the New York Times and Proto magazine as well as many financial websites and magazines.

Learn more about saving with an IRA.

- https://www.irs.gov/newsroom/401k-contribution-limit-increases-to-19000-for-2019-ira-limit-increases-to-6000

- https://www.thebalance.com/how-taxes-on-normal-ira-distributions-work-2388978

- https://www.irs.gov/tax-reform

- https://taxfoundation.org/2019-tax-brackets/

- https://www.fool.com/retirement/2018/12/23/the-6-best-tax-deductions-for-2019.aspx

- https://www.bankrate.com/finance/taxes/get-a-tax-deduction-for-charitable-giving-1.aspx

- https://www.forbes.com/sites/kellyphillipserb/2018/11/15/irs-announces-2019-tax-rates-standard-deduction-amounts-and-more/#237e24a32081

- https://www.bankrate.com/finance/taxes/take-advantage-of-the-sales-tax-deduction-1.aspx

- https://www.forbes.com/sites/kellyphillipserb/2018/02/22/irs-issues-guidance-for-deducting-home-equity-loan-interest-under-the-new-tax-law/#1ea1abb64536

- https://www.efile.com/tax-credit/dependent-care-tax-credit/

- https://www.irs.gov/credits-deductions/individuals/llc