As an investment option, the CD, or certificate of deposit, which yields a guaranteed rate during a fixed term, is typically among the highest-yielding FDIC-insured vehicles available to savers.

But those yields come with certain restrictions. They require you to keep your money deposited for a fixed length of time, typically between six and 60 months. The best CD interest rates typically come with longer durations. And although you can cash in your CDs early, doing so usually results in early withdrawal penalties that can erode your initial investment.

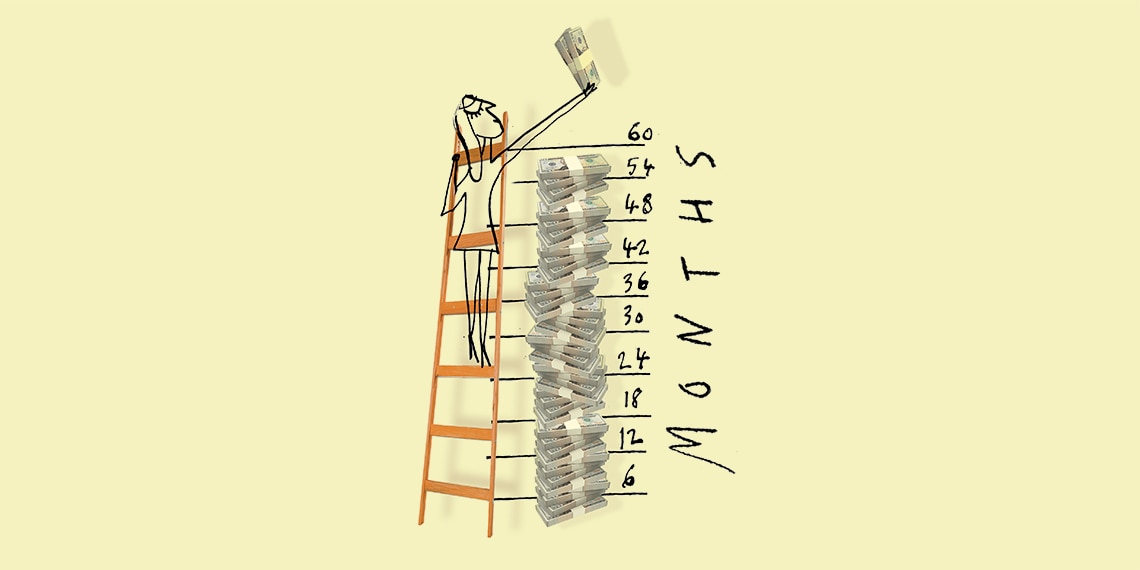

That’s why savers who want the highest possible rates, along with partial liquidity, often use CD ladders. You deposit your money into a series of CD accounts with term lengths that will mature at different times. That way, you have regular, penalty-free access to your cash if your plans change.

Here’s how a CD ladder works. To start, you might make CD investments in certificates with 6-month, 12-month, 18-month, 24-month, 30-month, 36-month, 42-month, 48-month, 54-month and 60-month durations. When that first 6-month CD matures, if you don’t need the cash immediately, you would continue laddering by converting it into a 60-month CD, and receive the five-year CD rate. Then you would repeat that conversion every time a CD matures, so you’d eventually have 10 separate 60-month CDs all earning that high interest CD rate, with the money becoming easily available every six months.

The interest on those CDs is fixed when you purchase them, regardless of what happens to interest rates afterward. And your deposit is protected by the FDIC, up to $250,000 per ownership category or account type. In other words, when it comes to CDs, laddering may help cautious investors reach greater heights, while still having regular access to some of their capital.

If you think you may need access to your capital sooner than six months, you may want to consider a high interest savings account or money market account, which allow frequent access to your assets, along with above-average interest rates. Otherwise, a CD ladder can be a great way to see higher than typical returns on your money.

Seth Kaufman is a journalist and ghostwriter based in Brooklyn. His work has appeared in the New York Times, The New Yorker online and many other publications.