What Is an Auto Lease?

• An auto lease is a contract with a car dealership that typically allows you to drive a new car for two to four years in exchange for monthly lease payments.

• In a lease agreement, you do not own the vehicle; at the end of the lease, you must return the car to the dealer.

• An auto lease often comes with lower monthly payments than a car loan does.

Finding a safe, reliable car you like for a price that matches your budget is often no simple feat. Leasing instead of buying can be one way to drive a new vehicle while spending less money upfront. Leasing can also help you keep monthly payments affordable and avoid maintenance costs you might encounter with an older vehicle.

While there are some benefits to lease agreements, however, there also are some trade-offs. Comparing these pros and cons and paying special attention to lease terms will help determine whether leasing is right for you.

How Auto Leasing Works

A lease provides a way to drive a new car for one or several years without buying it. Effectively, the lessor—typically a car dealership—agrees to “rent” the car to you for the term of the lease. You then make fixed monthly payments for the lease period.

At the end of a lease term, you have a few options. You can choose to:

• Return the car

• Extend the lease

• Buy it or trade it in for a new vehicle with a new lease

So, how do leasing and financing compare? Leasing typically offers lower monthly payments (on average you’ll save about $100 each month) than a loan for the same vehicle, and it often requires very little or even no money down. Meanwhile, financing a car purchase often requires a down payment, and it may take a sizable one to get monthly payments you can afford.

However, leases carry some restrictions on the use of your vehicle. That’s because the lessor is counting on the vehicle returning in good condition, so it can be sold on the used car market for an expected price. For instance, leases come with mileage limits (typically between 10,000 and 15,000 miles) and penalties for excess mileage, excessive wear and tear, and ending the lease early. There are no equivalent penalties for a car you’ve financed.

Another point to keep in mind: When you lease, you build no equity because you’re renting, not buying. With financing, on the other hand, you maintain some equity. And that can translate into trade-in value you can use toward the purchase of another car.

Who Should Lease?

Leasing won’t make sense for every car shopper, but it may be the right option if you:

• Want to drive a new car frequently. Some consumers value driving the newest model. In this case, leasing a new car every few years may be a good idea because new-car leases generally cost less per month than new-car loans.

• Prefer driving a vehicle you know hasn’t been neglected. Depending on its history, age and overall quality, a used car may require frequent trips to the mechanic. With a new leased car, on the other hand, any major issues are likely to be covered by warranty. Some leases include regular maintenance, but most put the burden on the lessee.

• Don’t have the cash for a down payment or want a better vehicle than you can afford. If you need a reliable car right now and don’t have the savings to buy one, leasing may be the quickest and most cost-effective way to get the wheels you need.

How to Evaluate a Lease Agreement

Lease agreements are contracts that spell out the rules of the transaction. Before you sign a lease agreement, pay attention to the following details:

• Purchase price. Even if you plan to lease, start by negotiating with the dealer for a better price. Don’t skip this step. Your monthly payments are based on purchase price, so the lower it is, the lower your monthly payments will be.

• Open-end or closed-end? The lease contract will set a “residual value,” which is a projection of what the car will be worth at the end of the lease term. With an open-ended lease, the dealer will determine the value of the car, based on its mileage and overall condition, once you return it. If it’s worth more than expected, you’re refunded the difference. And if it’s worth less than expected, you pay the difference. A closed-end lease specifies at the outset what the car will be worth when returned. You only pay extra if you exceed limits elsewhere in the lease.

• Monthly payment. In addition to purchase price, your monthly payment depends on several factors, some of which are negotiable and may vary from dealer to dealer. These factors include:

o Your credit score and down payment. Higher credit scores and bigger down payments may help secure lower monthly payments.

o Depreciation. The amount of market value the car will lose over the course of the lease. In general, the higher the residual value, the lower the amount of depreciation you will have to cover in your lease payments. To pay less in depreciation costs, choose a car that will hold its value well. Check Kelley Blue Book (at KBB.com) to find a car make and model that won’t depreciate quickly.

o Capitalized cost. The beginning lease balance, which can be reduced by cash down and trade-ins.

o Rent charge. This is simply the interest rate on a lease but expressed as a decimal number. The amount you pay will likely depend on your credit score.

o Use tax. The equivalent of sales tax, which you may owe on each monthly payment.

• Normal wear and tear. Lessees are typically not on the hook for “normal wear and tear”—you already pay for it through the lease. Normal wear and tear usually includes damage such as small dings, scratches and stains, and worn tires.

• Excessive wear and tear. Lessees may have to pay for damage that extends beyond typical wear and tear. This usually includes broken or missing parts, large dings and scratches and bent or broken wheels or rims.

• Mileage limits. Most lease agreements limit the number of miles you can drive the car each year before incurring a penalty, but this limit is negotiable.

• Early termination charges. These fees for ending the lease early will be specified in the agreement.

• Disposition fee. A one-time fee typically charged when you turn in the car. Not all leases include this fee, which helps cover costs of preparing to sell the returned car. You may be able to avoid paying the fee if you end up buying out the lease or entering a new lease when you turn the car in.

• Purchase option. Some leases give the lessee the option to purchase the car at the end of the lease term.

Leasing a car is one way to get an affordable vehicle you can count on. And for some consumers, it may make more financial sense than buying. Study all the costs and trade-offs so you know you’re making the choice that’s right for you.

For a busy business owner, leasing delivers simplicity and reliability

Mike O’Brien’s spare time and attention were scarce when he was building his business. The Oswego, N.Y.-based jeweler found himself completely consumed by his work. So, when it came time for a new car, he sought the simplest solution. “I was looking to save time and headaches anywhere I could,” he says.

O’Brien needed a vehicle that would get him to and from his customers without fail, so a reliable car was his top priority. He also wanted a car that was unlikely to need many costly repairs.

As O’Brien weighed his options and did the math, a lease emerged as the right solution for him. Leasing would allow him to get a new car—with few potential maintenance issues. And he was confident he wouldn’t go over the mileage limit or put the car through excess wear and tear, so potential fees weren’t a big concern.

He also liked that when the lease was up, he wouldn’t have to think about selling it or haggling over its trade-in value—he’d simply turn in the car. “For me, the lease was worth it,” he says.

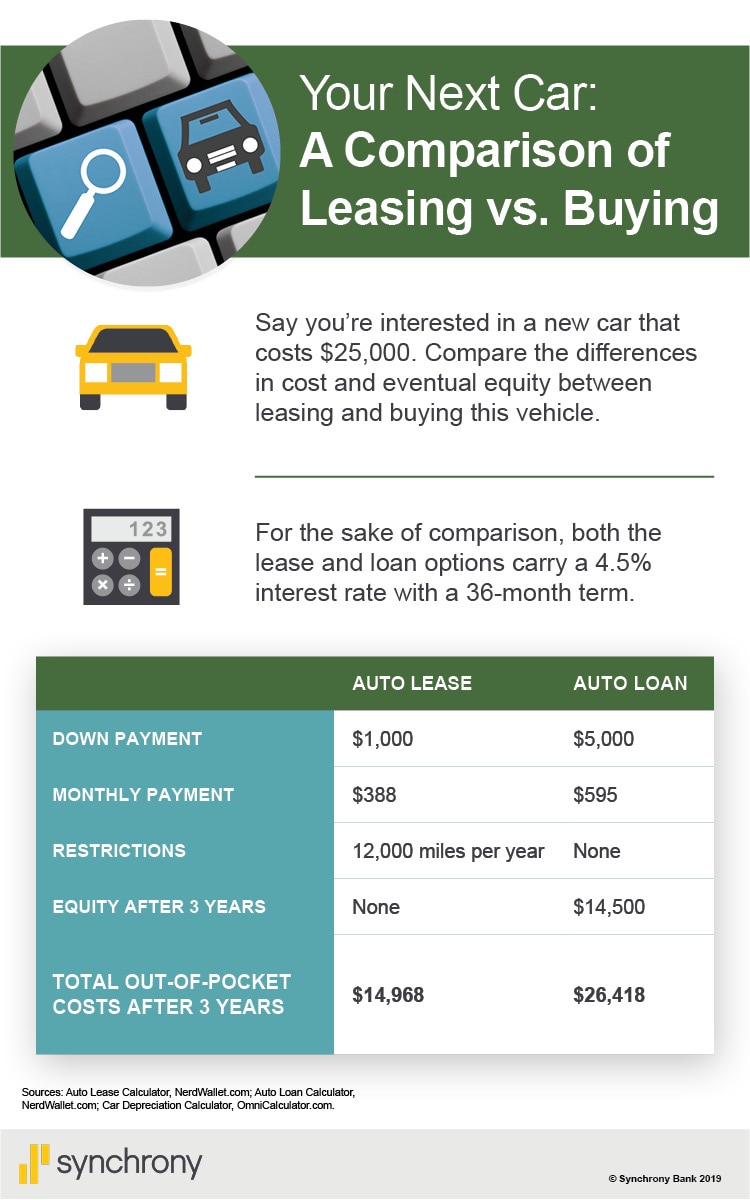

This chart is called A Comparison of Leasing vs. Buying. Say you’re interested in a new car that costs $25,000. Compare the differences in cost and eventual equity between leasing and buying this vehicle. For the sake of comparison, both the lease and loan options carry a 4.5% interest rate with a 36-month term. If your Down payment on a lease is $1,000 and on a loan would be $5,000, the total out of pocket at the end of a 3 year lease would be $14,500 and after 3 years of a loan would be $26,418. But you have no equity in the lease. Its sources are Auto Lease Calculator, NerdWallet.com; Auto Loan Calculator, NerdWallet.com; Car Depreciation Calculator, OmniCalculator.com.

Param Anand Singh writes about money, investing, art, and culture from his home in Henderson, New York.