Say you’re teaching your son and daughter to ride their bikes—a challenge that both of them are equally ready to tackle. Safety first, so you drive to the store to pick up helmets for them. Would you be surprised to find that a boy’s helmet, which has a shark on it, costs $14.99, while the girl’s version of the same helmet from the same company, which has a unicorn on it, costs $27.99?

Life is expensive, but even more so for women. A combination of challenges in pay, employment, cost of living and life span make saving a different proposition for women. Here’s why—and what you can do about it.

Challenge 1: A higher cost of living for women

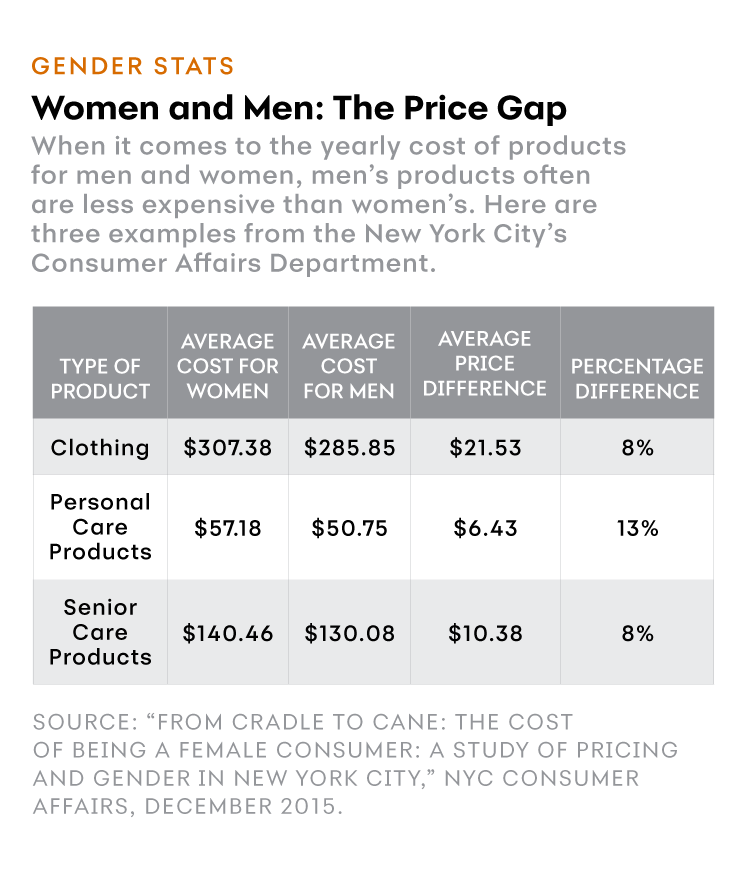

Most consumer goods aimed at women cost more than the equivalent products specifically for men. The difference can range from just 6% for sweaters or dress pants, to 48% for shampoo and conditioner. When you factor that into everything you buy, the combined results can add up to a lot of money over the course of a lifetime.

Challenge 2: Women are often unpaid caregivers

Women are far more likely than men to take extended leave from paying work to take care of their families. According to one study, 42% of mothers reduced work hours to take care of a family member, versus 28% of fathers, and 39% of mothers took significant time off, versus 24% of fathers. Not only do women spend less time earning, but they are also less likely to set aside money during those periods for retirement or other future plans.

Challenge 3: Women often work in lower-paying fields

Despite some progress, overall women earn less than men, with a 2015 report showing that women’s earnings were 79.6% of men’s. This is a challenge across the economic and educational spectrum, but it’s particularly serious for women without high school diplomas, who have experienced a 9.7% drop in weekly earnings since 1979, when adjusted for inflation, according to the same report. Overall, women account for more than 60% of workers paid at or below minimum wage.

Challenge 4: Healthcare costs are higher for women

On average, women in the United States live longer than men, which means higher healthcare costs. According to the Social Security Administration, a man turning 65 today can expect to live to be 84.3, while a woman turning 65 can expect to live to 86.7. As a result, women can expect to pay more over their lifetimes for healthcare. A 65-year-old woman can expect to spend more than $306,000, while a 65-year-old man can expect to pay much less—an average of more than $260,000, according to a recent survey.

What’s the best course forward for women?

Once you know what you’re facing, there’s actually a lot you can do to prepare. “The three most powerful words in personal finance are start saving now,” says Joanna Nowak, a Certified Financial Planner and Wealth Planner at MoneyWise in San Francisco. Here are some tips to keep in mind as you focus on saving:

● Do it often: Make a plan to set aside money from each paycheck for retirement, and be consistent.

● Think before you leave the workforce: Staying in the workforce longer can have a twofold benefit—you delay spending retirement savings, and you can accrue more money.

● Look for better saving tools: Consider the return and the interest on the money you save—you’ll want the money you set aside to retain its worth in the face of inflation.

Most of all, stay informed about your finances. The more you know, the better you can prepare to take care of yourself, and the people you love.

This chart falls under the subject of "Gender Stats," and is titled "Women and Men: The Price Gap." The introduction reads, "When it comes to the yearly costs of products for men and women, men's products often are less expensive than women's. Here are three examples from the New York City's Consumer Affairs Department. There are three products discussed: clothing, personal care products, and senior care products. For clothing, the average cost for women is $307.38 and the average cost for men is $285.85, which is a difference of $21.53 , or 8%. For personal care products, the average cost for women is $57.18 and the average cost for men is $50.75, which is a difference of $6.43, or 13%. For senior care products, the average cost for women is $140.46 and the average cost for men is $130.08, which is a difference of $10.38, or 8%. This data comes from a report from the New York City Consumer Affairs Department dated December 2015. The report is titled "From Cradle to Cane: The Cost of Being a Female Consumer: A Study of Pricing and Gender in New York City.

Marcia Lerner lives in Brooklyn, New York, and writes on finance, health care and children's literature. Her articles and reviews have appeared in the New York Times and Proto magazine as well as many financial websites and magazines.

- https://www1.nyc.gov/assets/dca/downloads/pdf/partners/Study-of-Gender-Pricing-in-NYC.pdf

- http://www.pewresearch.org/fact-tank/2015/10/01/women-more-than-men-adjust-their-careers-for-family-life/

- https://www.dol.gov/wb/resources/Womens_Earnings_and_the_Wage_Gap_17.pdf

- https://www.ssa.gov/planners/lifeexpectancy.html

- http://www.hvsfinancial.com/wp-content/uploads/2016/12/Women_Retirement_Health_Care.pdf